Summary

- Altria has a long history of rewarding shareholders with ample returns of capital via dividends.

- MO has been a perpetually cheap, hated stock, but one of the best long-term performers in the S&P 500–due to its high return on equity and dividend-friendly policies.

- The market has again punished MO stock for its acquisitions of Juul and Cronos. Management strategy now pivots to increased dividends and buybacks.

- My stock forecast for Altria for 2026.

I was frankly shocked that Philip Morris would be the number-one (performing) stock,” Siegel said. “I would just never have guessed that. I would have said, ‘Maybe IBM.’”

-Wharton professor Jeremy Siegel (on studying the best performing stocks in the S&P 500).

Is Altria Stock a Good Buy?

Altria Group (MO), formerly known as Philip Morris, is one of the cheapest large-cap stocks on the market today, a position that is not historically uncommon for the company. Despite this, Altria was found to be the best performing stock in a study by Wharton professor Jeremy Siegel from 1925 to 2003. Other winners included pharmaceutical companies and Standard Oil, which later became Exxon Mobil (XOM). My own research has shown that despite ups and downs, MO stock has continued to perform exceptionally well in the time since Siegel did his original study.

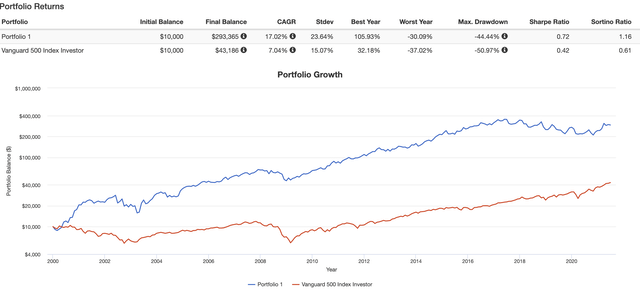

Indeed, $10,000 invested in MO at the turn of the 21st century would be worth over $293,000 with dividends reinvested, vs. a little over $43,000 for the S&P 500. There are stocks that have performed better since the turn of the century, but what separates MO from other stocks over the last 100 years is the company’s enduring profitability and compound return that has spanned lifetimes.

Source: Portfolio Visualizer

Tobacco is a high-margin, capital-lite business, and importantly for today, one that has little to no earnings sensitivity to inflation or the specter of a third wave of coronavirus. With many other high-quality businesses trading for 20x earnings, 30x, 40x, or 50+x earnings, Altria can be had for roughly 10x 2021 earnings estimates. I see a lot to like with Altria, but before I make a stock forecast for Altria, I’ll go into some reasons why the valuation is so low at less than half of the P/E ratio of the S&P 500.