What happened

Shares of General Motors (NYSE:GM) were moving higher last month after the legacy automaker took a number of steps toward embracing a fully electric future, earning some of the attention that investors have showered on EV stocks over the past year.

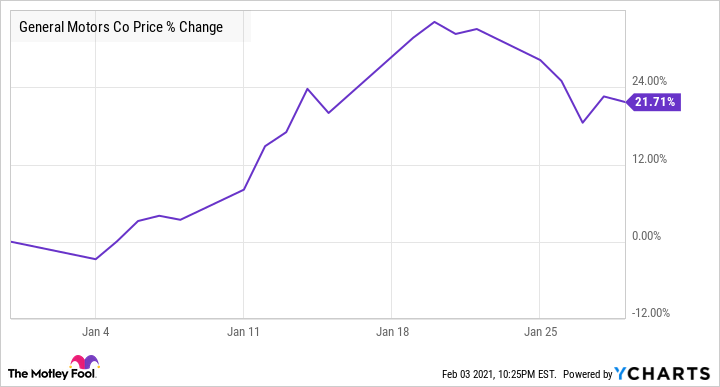

The stock finished January up 21%, according to data from S&P Global Market Intelligence. As you can see from the chart below, the gains covered most of the month before pulling back toward the end of January.

So what

The company kicked off January announcing blowout sales for the fourth quarter, with unit sales up 5% year over year in the U.S., and gains in market share in every major category. In China, the company’s biggest market, sales grew 14.1% in the quarter. The stock went up 6% in the two days those announcements came out.

Image source: General Motors.

On Jan. 12, the stock jumped again after the company announced the creation of BrightDrop, a new business segment built around an integrated ecosystem of electric vehicles and systems, including cargo vans and electric pallets. The company expects to begin delivering the cargo van, the EV600, by the end of the year.

The following week, the stock got another boost when it said that Microsoft would participate in a $2 billion funding round, along with Honda, in GM’s Cruise division, which is now valued at $30 billion.

Toward the end of the month, GM was one of several large-cap stocks that pulled back on the Reddit short squeeze, perhaps as investors cashed out shares to put that money to use elsewhere, and the company also announced plans to go carbon neutral by 2040 and eliminate tailpipe emissions from light-duty vehicles by 2035.

Now what

With those announcements, GM is staking out the pole position among legacy automakers in the EV race. It’s a smart move, considering investors have richly rewarded EV makers over the past year (even NIO, the Chinese EV-maker, now has a bigger market cap that GM). With its manufacturing capacity and brand reach, the company has a number of advantages over pure-play EVs, and those shouldn’t be overlooked.

Investors should learn more about the push into EVs when the company reports fourth-quarter earnings on Feb. 10. Analysts are expecting revenue to increase 17.2% to $36.1 billion and for earnings per share to jump to $1.66, from $0.05.

Should you invest $1,000 in General Motors Company right now?

Before you consider General Motors Company, you’ll want to hear this.

Investing legends and Motley Fool Co-founders David and Tom Gardner just revealed what they believe are the 10 best stocks for investors to buy right now… and General Motors Company wasn’t one of them.

The online investing service they’ve run for nearly two decades, Motley Fool Stock Advisor, has beaten the stock market by over 4X.* And right now, they think there are 10 stocks that are better buys.

*Stock Advisor returns as of November 20, 2020