Summary

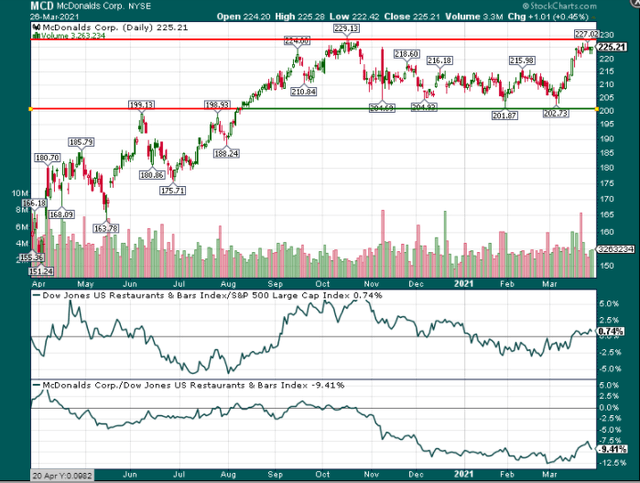

- MCD trades very near its all-time high again.

- The stock has been range bound for months, and for good reason.

- I see MCD hitting resistance and moving back down to the bottom of the channel once more.

Restaurant stocks were initially hammered during the initial stages of pandemic-driven panic, but then sharply recovered. That included chains large and small as the worst-case scenario never came to fruition, and chains that offered customers high level of convenience thrived.

One such example is “you want fries with that” legend McDonald’s, which made new all-time highs only months after the pandemic set in.

Shares hit $229 in October, but since then, have been range bound between ~$200 and $229. Shares go for $225 as of this writing, right at the top of the range. However, given what I’ll discuss below, I think McDonald’s lacks catalyst for an upside breakout, and will likely remain range bound for the time being.

Share price ahead of fundamentals

I won’t dispute that McDonald’s is the king of all things fast food. It has been that way for many years as the company shook off a terrible menu and equally as unsavory reputation in the ’90s, only to reinvent itself and resume taking over the fast food world. This company is an icon of what it means to run a successful business globally, and I’m not here to argue about that.

What I am here to say is that the run the stock has had is too much, and I believe it has been range bound for six months for very good reason.

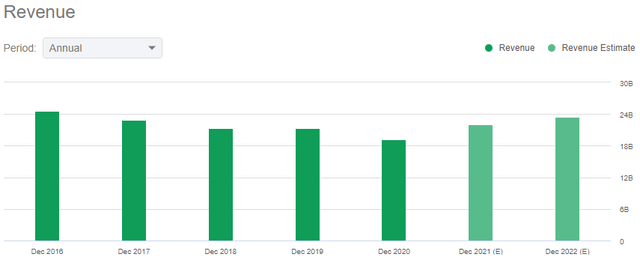

To understand why I feel that way, we must understand the context of McDonald’s current situation. Below, we have revenue for the past several years, as well as estimates for this year and next.

Source: Seeking Alpha

Revenue declined into 2020 principally because of the refranchising effort the company went through in recent years to unload most of its formerly company-owned stores. This has been discussed at length in various places so I won’t go through the whole saga. But the idea is that lower revenue yields much higher margins, so all is well.

Now that the refranchising effort is complete, we should start to see growth again. And indeed, that is exactly what is forecast for this year, with revenue slated to be roughly what it was in 2019.

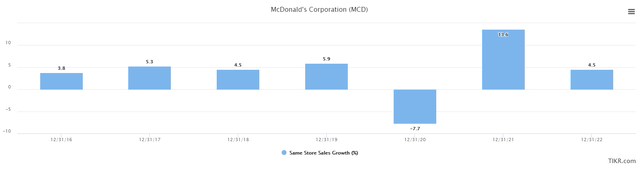

Part of that is because McDonald’s is pretty good at boosting systemwide sales each year in the low-single digits. But the other part is that the company is making up lost ground from the pandemic, which can be best illustrated with comparable sales.

Source: TIKR.com

Last year was a disaster for McDonald’s, which is used to 4%+ gains in comparable sales, but which posted a decline of nearly 8% last year. Of course, this was due to temporarily reduced demand, not because McDonald’s forgot how to operate. The good news is that this year is currently expected to see a mid-teens rebound in comparable sales, retracing 2020’s decline and then some, and getting the company back on track. That’s great, but keep in mind that the projected gain for this year, indexed to 2019 levels, represents something like a 4.9% gain over a two-year period. That’s okay, but it isn’t like McDonald’s is on some flyer with massive comparable sales gains above what it used to do. This is still technically below-trend growth over a two-year period for McDonald’s, so optimism around the rebound this year should be muted.

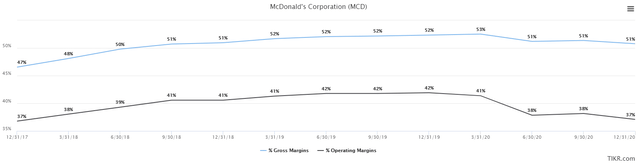

In addition, the big fanfare around the refranchising effort is because it means much higher margins. Indeed, as we can see below with gross margins and operating margins, the process is infallible.

Source: TIKR.com

The problem here is that there is a very clear plateau at ~53% gross margins and ~42% operating margins. Those are very high numbers for a restaurant, but from a growth perspective, there appears to be a pretty hard ceiling. In other words, the refranchising effort worked, but now that it’s complete, there doesn’t appear to be any sort of meaningful upside to margins left in the tank. That’s a problem for earnings growth.

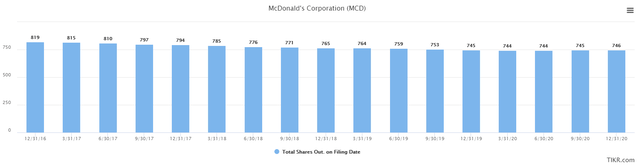

If you’re keeping score at home, there are three basic ways for a company to grow EPS. First, it can grow revenue. Second, it can grow margins. And third, it can reduce the float on which EPS is calculated.

Source: TIKR.com

We can see above that McDonald’s has never been a huge buyer of its own shares, but even its formerly slow pace turned into basically nothing in recent quarters, even prior to the pandemic. Thus, we cannot reasonably expect any kind of substantial movement here, either.

To recap, revenue should grow at mid-single digit rates, commensurate with comparable sales increases, margins hit a ceiling in early 2020 with no catalysts to move higher, and the float is basically stagnant. That’s not a particularly appetizing EPS growth equation, but don’t tell that to overly bullish analysts.

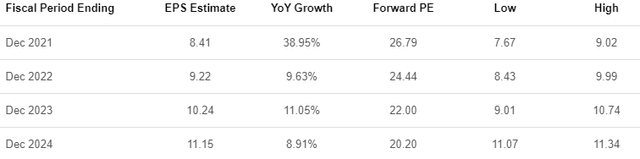

Let’s value this thingBy my reckoning, McDonald’s should see a rebound this year because margins suffered last year from unsustainably low demand. That situation has been rectified, however, and I fully expect a normalized year of earnings for this year, which accounts for the spike in revenue and what should be rapidly reflating margins. The problem is that as we look beyond this year, analysts are way too bullish.

Source: Seeking Alpha

Next year is supposed to see nearly 10% growth, followed by 11%, followed by 9%. Where is this coming from? A 4% or 5% comparable sales gain, margins that should be reflated back to the ceiling by the end of this year, and essentially no float reduction don’t give us anything like 10% annual growth. Unless McDonald’s has figured out a way to chip away at its margin ceiling – which seems unlikely given how high it is – or suddenly buys back a huge amount of stock, I just don’t see it. I see 5% to 7%, but not 10%.

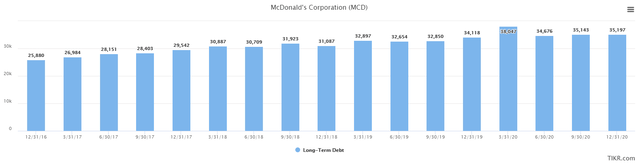

The company also sports an enormous amount of debt, which you can see below.

Source: TIKR.com

Interest expense is now ~$1.2 billion annually, which is about 14% of operating earnings for 2019, the last year before the pandemic (that percentage is much higher for 2020). Not only does this level of debt reduce the company’s flexibility going forward, but it also means one in every seven dollars of operating earnings goes to service debt. That comes right out of EPS.

Now, let’s take a look at a couple of ways to value it and show why I think it will struggle to continue to move higher. We’ll start with enterprise value to revenue.

Source: TIKR.com

This metric has soared since the company announced it would refranchise its stores. That makes sense because the amount of earnings the company makes on franchise revenue is much higher than company-owned store revenue. Even accounting for this, EV to revenue is very near its all-time high, going for a multiple of 10X today. That’s inextricably expensive for a restaurant chain, and in particular, one that has already accrued the benefits of higher margins. If McDonald’s were still seeing margins rocket higher, I could get it, but there was a very clear ceiling set almost two years ago, so I don’t.

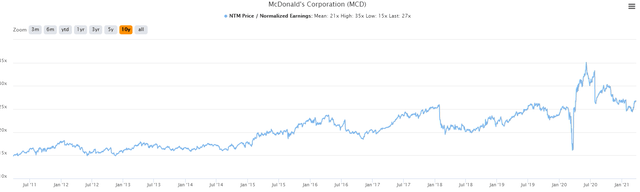

On an earnings basis, the picture is slightly better, but only just.

Source: TIKR.com

Shares go for 27X forward earnings today, which is more than its entire history apart from the pandemic’s early stages when earnings plummeted. Under normalized conditions, 27X forward earnings is the highest valuation the stock has ever traded for. I’m not really that interested in paying all-time high valuations for any stock, but in particular, one that I believe faces a tough road ahead in terms of hitting analyst estimates.

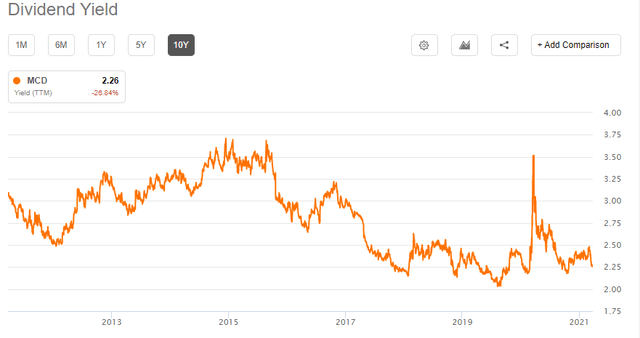

Finally, if you still think McDonald’s is somehow cheap, the dividend is telling you the same thing as the above; this stock is priced for perfection.

Source: Seeking Alpha

McDonald’s was cheap back in 2015 with its 3.5% yield; the current 2.2% yield is very near a decade low, despite faithfully raising the payout every year. The yield isn’t likely enough to draw in buyers, and with the stock looking overvalued on a variety of metrics, as well as it coming up against what should be resistance once again just a couple of dollars higher than the current price, I think you’re much better served waiting for the lower end of the channel to buy.