Boeing‘s long-serving chief financial officer will retire this summer, but the aerospace giant is taking steps to make sure CEO Dave Calhoun doesn’t quickly follow him out the door.

In a statement, Boeing said that Gregory D. Smith, who has served as CFO since 2011, will retire effective July 9. The board is also extending the company’s standard CEO retirement age from 65 to 70, allowing Calhoun, 64, more time at the helm.

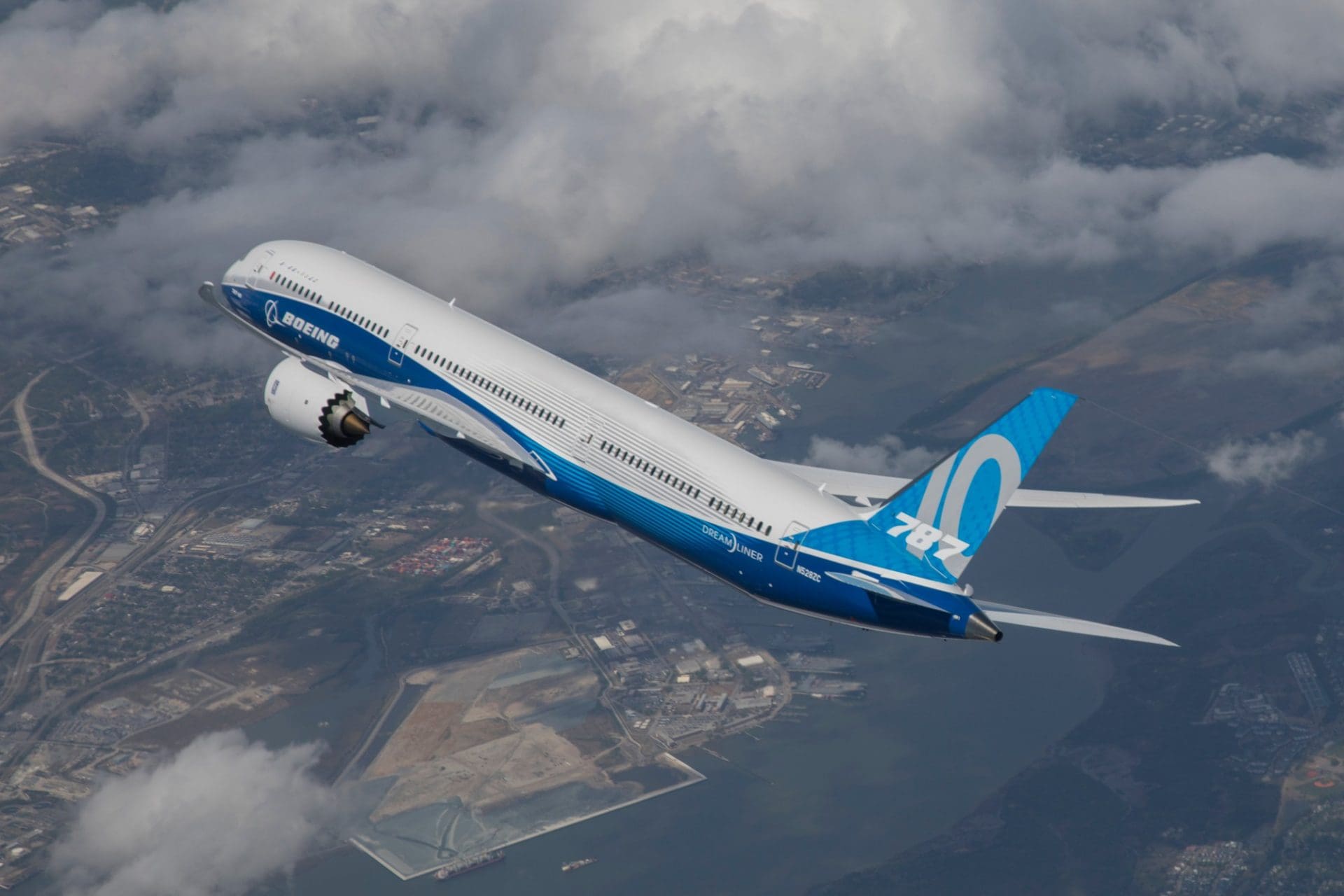

The shuffling comes as Boeing tries to turn the page after a disastrous couple of years. The company’s 737 MAX was grounded in March 2019 after a pair of fatal accidents, and only returned to the skies last fall. It has also been hit hard by the pandemic, which has cut into commercial airline demand for new planes.

Boeing’s board and management have faced heavy scrutiny due to the 737 MAX issues. Calhoun, then a director, took over as CEO in January 2020 after former CEO Dennis Muilenburg was forced out. But the company and its board remain under pressure.

Boeing noted that while the board’s action extends the mandatory retirement age for Calhoun to April 1, 2028, there is no fixed term associated with his employment.

Board chair Larry Kellner praised Calhoun’s work in navigating “one of the most challenging and complex periods in its long history” and said now is not the time to be considering a CEO swap.

Kellner added, “Given the substantial progress Boeing has made under Dave’s leadership, as well as the continuity necessary to thrive in our long-cycle industry, the board has determined that it is in the best interests of the company and its stakeholders to allow the board and Dave the flexibility for him to continue in his role beyond the company’s standard retirement age.”

Should you invest $1,000 in The Boeing Company right now?

Before you consider The Boeing Company, you’ll want to hear this.

Investing legends and Motley Fool Co-founders David and Tom Gardner just revealed what they believe are the 10 best stocks for investors to buy right now… and The Boeing Company wasn’t one of them.

The online investing service they’ve run for nearly two decades, Motley Fool Stock Advisor, has beaten the stock market by over 4X.* And right now, they think there are 10 stocks that are better buys.