- Zillow’s growth rates are choppy and difficult to accurately predict, even amidst the housing boom.

- This investment thesis comes down to whether investors sufficiently buy into its Zillow Homes opportunity or not.

- At approximately 6x forward sales, I suspect the stock is now close to fairly valued.

- Looking for more investing ideas like this one? Get them exclusively at Deep Value Returns. Learn More »

Investment Thesis

Zillow Group (Z) is a consumer real-estate platform. It has its crown jewel IMT segment, which is an advertising segment, with very high profit margins and is rapidly growing. But Zillow is also attempting to grow its Zillow Homes segment, which is very capital intensive.

After the recent tech sell-off, this stock is now at close to 6x forward sales, but this could be now fairly valued.

When it comes down to it, it’s all about investors’ view on Zillow Offers and if that could become a compelling enough opportunity.

Why Zillow? What’s at Play?

Zillow allows customers to sell, buy, rent, or financing residential real estate. During Q4 2020 Zillow saw 201 million users accessing its platform, a 16% increase y/y. This is at the core of the thesis, that Zillow is technological-enabled and well set up to benefit from the world’s rapid digitalization post-COVID.

Zillow has three segments: Homes, Internet, Media & Technology, and Mortgages. As a reminder, Zillow’s IMT segment primarily derives revenues from allowing agents to advertise properties on its websites, and this is what’s particularly attractive and worthwhile considering in this investment.

For context, not only is IMT being guided to have grown by approximately 29% y/y in Q1 2021 but it’s also delivering EBITDA margins of nearly 43% at the high end of its guidance. However, I get ahead of myself, and we’ll circle back to its growth opportunity.

The unavoidable truth is that Zillow is attempting to gain market share in its Zillow Offers segment, the main constituent of its Homes reportable segment.

And what this thesis ultimately boils down to is whether investors have enough belief that customers will value the convenience of going from shopping around on Zillow’s website to actually buying and selling to Zillow. Keep in mind, customers are trying to maximize the sale price of their property. So rather than being time-sensitive, customers are price-sensitive and looking for the best price to sell and buy.

For context, Zillow sold 923 properties in Q4 2020 compared with its peer Opendoor Technologies (OPEN) which sold 9,913 properties over the same time frame. Needless to say that both companies have had to operate in the same environment, and both companies saw the numbers of properties sold fall by close to half compared with the same period a year ago. This was largely expected given the COVID backdrop, but worth putting out there for comparison sake.

Furthermore, Zillow’s Offers operates on the idea that it’s already got more than 200 million users on its digital properties browsing for properties, then why not attempt to broker a deal for them too? If you already have acquired the customers’ eyeballs, why not have them sell you their property? And the answer to that question is controversial with both bears and bulls have their own response.

Revenue Growth Rates Are Volatile

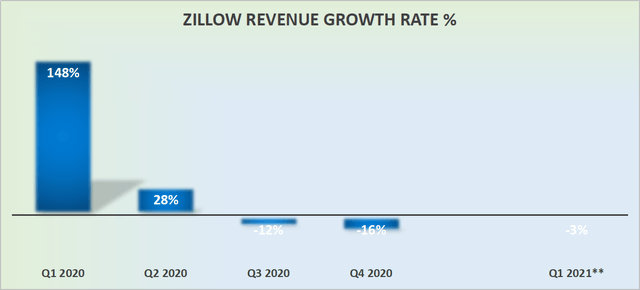

Source: author’s calculations; **high-end company guidance

So now we get into the heart of the thesis: it’s very difficult to ascertain what sort of growth rates investors can expect from Zillow on a sustainable basis. Clearly, Q1 2020 was an impressive quarter, but can Zillow return to plus 20% growth rates any time soon? And equally importantly, can it sustain it?

And now, just to further complicate the thesis, as I’ve alluded to, Zillow’s growth strategy is contingent on its success on its Zillow Offers business. The problem though is that this business is incredibly capital intensive. And that will play a role in how investors will value Zillow as a whole.

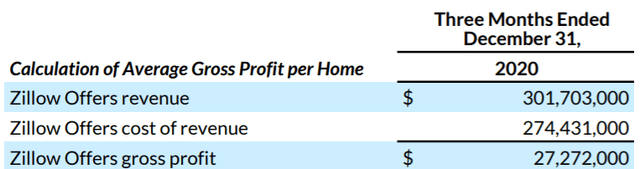

Source: Q4 2020 Shareholder Letter

For example, when Zillow Offers sells a property, it must also deploy capital to buy up another property. Thus, what happens is that its gross profit margins end up being close to 8%. That’s not a high-quality business opportunity, particularly if you haven’t got enough scale or any significant competitive advantage over any other property seller.

Valuation – Fairly Priced Already

I’ve obviously noted that a large number of tech stocks have meaningfully repriced of late. Thus, given all the buzz around the property market being so hot once again, we could be excused for declaring that paying up less than 6x forward sale for Zillow is a satisfactory opportunity.

But I’m unsure if that’s the case, because, as I’ve remarked throughout, its biggest growth initiative carries absolutely razor-thin gross profit margins, and not even breakeven EBITDA margins.

Readers may retort that Zillow’s Mortgages segment is very attractive and carries high EBITDA margins, but I’m unsure if at less than $14 million in Q4 2020 that’s a needle mover on this investment thesis as a whole.

The Bottom Line

In sum, the stock appears to be cheaply valued at less than 6x forward sales. But to argue that this is a cheap investment opportunity, investors have to have a very strong conviction that Zillow Homes could be a strong opportunity for the company, and that its capital-intensive model could soon be a strong cash flow generator once Zillow Homes attains a large scale.

I remark that right now, after the recent sell-off in tech, there are better investment opportunities elsewhere.