Summary

- Microsoft continues to steadily compound its bottom line EPS at 30%.

- How investors should think about its biggest growth engine, Intelligent Cloud.

- Microsoft is still not fully priced, despite being a household name.

- Looking for more investing ideas like this one? Get them exclusively at Deep Value Returns. Learn More »

Investment Thesis

Microsoft makes up the fabric of the modern work environment. What it lacks in terms of headline-grabbing impressive top-line growth rates, Microsoft more than makes up for with its strong EPS growth rates, typically reaching 30% y/y over 3 and 5-years.

Investors often seek out ”cool” and fast-moving stocks as they believe that’s what required to see meaningful upside potential in their holdings.

In fact, I contend that investors would in fact do very well to simply buy into this tech giant that’s hiding in plain sight.

Why Microsoft is Still a Compelling Buy

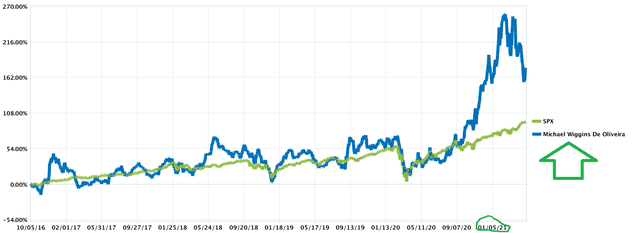

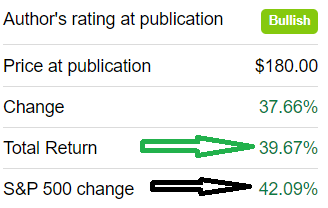

This time last year I was bullish on Microsoft, arguing that the stock was undervalued:

Source: Seeking Alpha

Source: Seeking Alpha

I had no idea that the whole of the market would jump ahead so that the S&P 500 (SPY) would churn out 42% in twelve months to the point that Microsoft’s return of 40% would actually transpire to have underperformed the S&P 500.

Not only does this put things in perspective, but it fundamentally speaks of the states of affairs where 40% in twelve months is no longer “good enough” and is an underperforming stock.

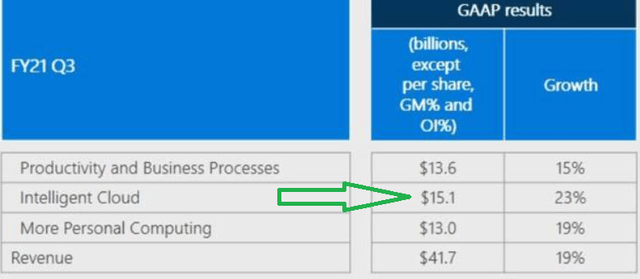

Source: Microsoft Q3 2021 Investor Presentation

Moving on, as you can see above, Microsoft’s Intelligent Cloud segment is now clearly outdistancing itself from its other two segments. This is a trend that started to pick up speed as COVID hit, but has now dramatically outpaced the other segments since COVID and is showing no signs of slowing down any time soon.

To illustrate, Intelligent Cloud is Microsoft’s biggest segment, but it’s also printing the fastest revenue growth rates at 23% y/y. As you know, this segment’s growth rates are being driven by Azure, which is still delivering revenue growth rates of 46% (currency-adjusted), versus 32% for Amazon’s AWS during the same period.

Moreover, both tech giants have consistently remarked that the demand for digital technology hasn’t slowed down despite the challenging comps with last year.

In actuality, both behemoths argue that they are seeing enterprises outsourcing their digital infrastructure needs to large cloud providers. And if you think about it, this makes a lot of sense: why embark on a cost-prohibitive and time-consuming journey when the best cloud providers with complete tech stacks are ready with off-the-shelf solutions? There’s simply no need.

On this front, needless to say, that Azure continues to shine. As you would expect, given that no head of IT would ever be sacked for recommending Azure irrespective of Azure’s cost. Hence, Microsoft is able to join its exemplary brand name together with its unmatched IT distribution to get into all enterprises.

Moving on, companies’ demand to not only have productivity platforms, but to also have seamless hybrid cloud analytics and communication tools are going to continue seeking out Microsoft for their productivity-from-anywhere requirements.

For example, consider that Teams right now has practically double the number of active users compared with this time last year. This ability of Microsoft to deliver users all-encompassing collaborative applications makes it a no-brainer purchase for practically all enterprises.

In other words, Microsoft can simply continue to increase the price of its cloud packages, and without much need for dramatic investment and sales teams, we can see dramatic operating leverage hitting its bottom line.

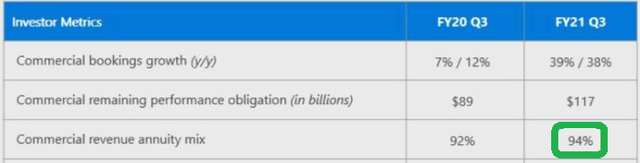

Source: Microsoft Q3 2021 Investor Presentation

Indeed, I contend that the real key to the bullish thesis and what I urge investors to keep in mind is that once Microsoft’s packages are part of the commercial setting companies aren’t going to churn out and adopt another package, and that’s why we can see that Microsoft’s Commercial revenue annuity mix is so incredibly high at 94%.

Valuation – Why Microsoft Still Has Upside Potential

I have hopefully impressed on readers that when it comes to Microsoft, investors should be happy to pay a premium for its stock because its platform is so sticky. Yet, for now, investors are not being asked to pay a premium for it.

What’s more, if we look over the past 3 and 5 years, Microsoft has been consistently grown its bottom line by approximately 30% CAGR.

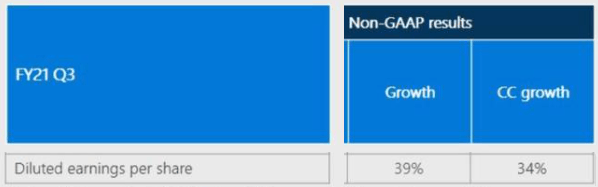

Source: Microsoft Q3 2021 Investor Presentation

Source: Microsoft Q3 2021 Investor Presentation

Indeed, as you can see above, Q3 2021 once again delivered 34% y/y EPS growth rates (constant currency).

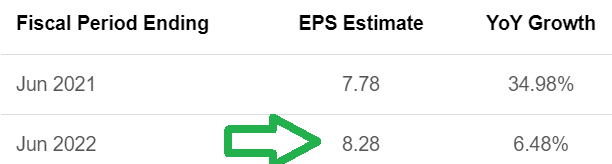

Meanwhile, if we look ahead to next year, fiscal 2022, ending June 2022, Wall Street analysts are somehow expecting Microsoft to decelerate its EPS growth and only eke out less than 7% y/y EPS growth rates.

Source: Microsoft Q3 2021 Investor Presentation

Source: Microsoft Q3 2021 Investor Presentation

Even if that were the case that Microsoft only grows its EPS by 7% y/y in 2022, the stock would be priced at 30x forward earnings, even though it’s clearly compounding at closer to 30% over prolonged periods of time.

Furthermore, another reason why I suspect that analysts will be raising their estimates over the coming twelve months is that Microsoft has been steadily increasing its buyback so that Q3 2021 saw its repurchases increase by 49% y/y.

The Bottom Line

For the time being, investors are not fully pricing in Microsoft’s potential. Microsoft is growing its EPS at more than 30% y/y over a period of years, leaving its shares trading at a discount to intrinsic value.

We can look high and low in the stock market right now, there are not many companies that are growing their EPS at 30% y/y that are still being priced at 30x forward earnings.

Author’s note: Readers may question why the author doesn’t have a position in MSFT given that he’s clearly bullish here and that’s because he prefers to invest in smaller cap stocks.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Honest and reliable service.

- Hand-holding service provided.

- Very simply explained stock picks. Helping you get the most out of investing.

- Balanced arguments.

- Long track record.