FinkAvenue

Summary

- Intel Corporation’s market capitalization has dropped over 35% YTD, despite progress on 5 nodes in 4 years to compete with TSMC.

- Intel’s financial performance remains strong with revenue and EPS growth, positioning the company for future success.

- Intel’s reputation has suffered from crashing CPUs, but the company’s outlook shows potential for growth and value as an investment.

- I am The Value Portfolio, an experienced analyst specializing in stock research and wealth growth. I run the investing group The Retirement Forum where I focus on ideas to prepare you for retirement.

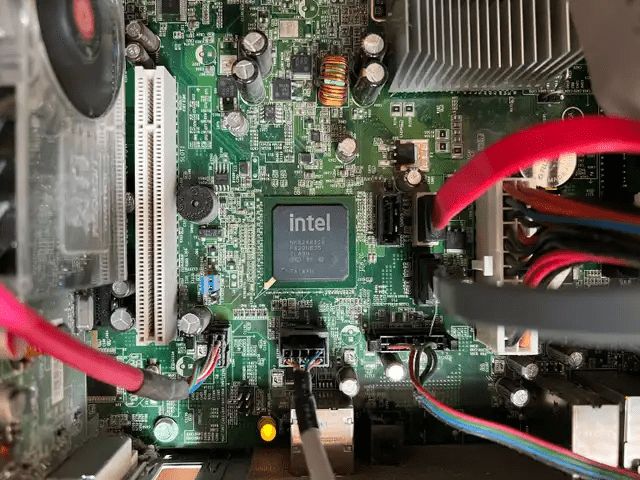

Intel Corporation (NASDAQ:INTC) has had a rough year, with its market capitalization dropping more than 35% YTD. That’s despite a strong core portfolio as the company continues to move forward on 5 nodes in 4 years, to become competitive with TSMC (TSM) again, while building its own processors on TSMC nodes to hedge against a downturn. As we’ll see throughout this article, this weakness makes Intel a valuable investment.

READ FULL ARTICLE HERE!