Summary

- Ford Motor Company is transforming itself to thrive in a challenging, dynamically changing macroeconomic environment.

- The first-quarter results of the company highlight the progress the company has made so far in achieving cost efficiencies.

- The second quarter of this year, as confirmed by the management, will be very challenging, and a drop in the stock price is likely.

- A closer look at the vehicle preferences of Americans paints a very promising picture of what the future holds for the company.

- Looking for a portfolio of ideas like this one? Members of Leads From Gurus get exclusive access to our model portfolio. Learn More »

Ford Motor Company (F) needs no introductions. We all know the company as a legacy automobile manufacturer, and it is no secret that the company has found itself in a tough spot. Over the last 10 years, revenue has failed to gather any sort of momentum, and the company is now bringing in just a fraction of the profits it used to before 2011. Ford is facing many challenges including highly competitive industry dynamics, changing consumer behavior, a rapidly evolving technological landscape that threatens the survival of legacy automakers, and the deteriorating investor sentiment toward companies that are yet to transform into environmentally friendly business models.

When it comes to investing in the stock market, it’s quite easy to predominantly focus on the past, thereby missing important developments that could shape the future of a company. After all, stocks are supposed to be forward-looking, so it would be reasonable to conclude that future prospects will have a meaningful say about the stock price of a company. Ford, as I will discuss in the remainder of this article, is making notable progress in implementing its new business strategy to focus on electric vehicles. The next 5 years could make or break Ford, and I’m betting on a successful turnaround of financial performance for reasons that will be discussed in this analysis.

The efficiency is bound to improve

One of the main reasons that led to operating inefficiencies in the past was the massive number of platforms used by Ford for different vehicle models. There were 27 platforms by 2007, and the company’s delay in identifying the cost disadvantages of this strategy resulted in a substantial deterioration of operating margins. At one point in time, the Ford Ka model had 3 different looks, one in South America, one in India, and the other in Europe. None of these cars shared the same platform, so Ford was unable to achieve cost efficiencies as sharing components between vehicles was impossible. Also, the company found it difficult to adapt to changing consumer tastes as well, and Ford consistently failed to address changing demand for certain vehicle models because of this lack of flexibility. The company, however, is now focused on building vehicles on 5 flexible architectures, which should help Ford address all these concerns in the future. These platforms include:

- A front-wheel-drive unibody for small cars and crossovers.

- A rear-wheel-drive unibody.

- A commercial vehicle unibody for vans.

- A body-on-frame platform for trucks.

- an all-electric car platform.

By limiting the number of platforms to just 5, the company will achieve cost efficiencies and much-needed flexibility to cater to changing levels of demand for vehicles. This is a good starting point to address some of the challenges that clipped Ford’s growth in the last couple of decades.

The reorganization of the global business strategy is another favorable development that could lead to operating efficiency gains. The company exited the heavy truck business in South America in early-2019 and closed down 3 manufacturing facilities in Brazil. This business segment was loss-making, and the company failed to gain enough market share to turn things around. The company is downsizing in Europe as well and is pushing for an all-electric vehicle fleet by 2030 (more on that later). The company quit the Russian market in 2019 and closed down 3 plants as well. In China, Ford plans to establish a direct sales network connecting 20 major cities, and the idea is to build a direct relationship with Chinese customers by offering a high-end purchasing and servicing experience. Ford’s strategy for China is centered on electric vehicles, and the company plans to leverage the strength of its Lincoln models to push this into a global luxury brand.

The only way to know whether this global reorganization plan has what it takes to become successful is to evaluate the numbers that we are currently seeing. For the first quarter of 2021, international operations delivered an EBIT of $500 million, which was a year-over-year improvement of more than a billion dollars. This is the best quarterly EBIT since 2013 from this segment, which is a testament to the fact that the company is headed in the right direction with its global strategy.

The electrification plan is more than what meets the eye

The future of the automobile industry is in electric vehicles, and Ford has acknowledged this reality. Europe has stricter zero-emission rules and requirements in comparison to the United States, so it makes sense to evaluate what Ford has come up with in Europe to remain competitive.

Ford, as confirmed by the management in the first-quarter earnings call, is on track to assemble its very first high volume all-electric passenger car in Europe by 2023, and the company is investing $1 billion in a new EV manufacturing facility in Germany. By 2024, Ford expects all European commercial vehicles to be compliant with zero-emission standards, and by 2030, all passenger cars in Europe are expected to be EVs. Ford accounts for a very small market share in the European market, and these initiatives might end up in lackluster market share gains as well. The point, however, is that Ford is moving in the right direction from a macroeconomic perspective, which gives me confidence in what the company will achieve in the all-important U.S. market.

Now, let’s get back to the United States. Mustang Mach-E is not news anymore, but the expected launch of the all-electric F-150 will be a game-changer in my opinion. According to data from Forbes, the Ford F-Series was the best-selling vehicle model in the United States in 2020. What I would like to highlight is that 9 out of 10 best-selling vehicles in the U.S. last year were SUVs or pickup trucks. This is not just a one-time trend. Historically, Americans have preferred SUVs and trucks over sedans, and this could be one of the primary reasons why EVs have gained traction in the United States at a much slower pace than Europe and China (due to the lack of availability of EV trucks). The next 2 years will be transformative for the U.S. auto industry as several all-electric SUVs and trucks will hit the market by the end of 2022, including Tesla Cybertruck, Rivian R1T, Bollinger B2, Ford F-150 EV, and Chevrolet Silverado EV.

What meets the eye is that EV sales will skyrocket in the next decade in the United States and that Ford will be a frontrunner in this growth story. Ford is likely to report meaningful revenue growth in the next 5 years, which is also something that is not too hard to decipher. What does not meet the eye is that Ford is likely to trade at substantially higher valuation multiples when the company becomes a prominent player in the American EV industry. An expansion of valuation multiples is very much in the cards, similar to how The Walt Disney Company (DIS) attracted very high earnings multiples after entering the streaming industry.

Let’s plug some numbers into the story

Whenever I scroll through the comments section of Seeking Alpha articles, I invariably come across readers who believe trying to find the intrinsic value of a company is a futile task. One of the most common arguments made by these readers is the uncertainty associated with future cash flows. This is absolutely true, but then again, if we do not have at least a vague idea about the actual value of a company, there would not have been any difference between investing and gambling. True, we will never get the intrinsic value estimate correct, but if we can at least come close, we will not only make money in the market but will also avoid costly mistakes. On the other hand, if an investor believes in efficient market hypothesis, it simply wouldn’t make sense to do all this research, and buying an ETF that tracks the S&P 500 Index would have been the right choice.

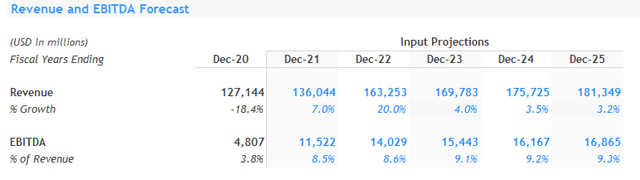

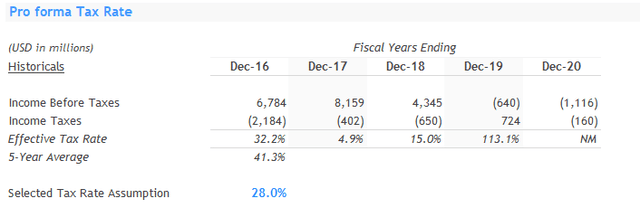

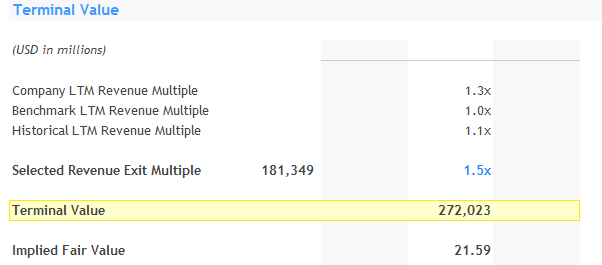

With this, let’s have a look at my earnings model for Ford. I used as conservative numbers as possible, and I used an above-average revenue multiple to calculate the intrinsic value to reflect my expectations for higher valuation multiples in the future. 2022, as far as I see, will be an inflection point in Ford’s story as the success of the all-electric F-150 will more or less determine where the company is headed in the next decade.

Exhibit 1: Selected valuation assumptions

Source: Author’s assumptions and calculations

The intrinsic value estimate of $21.59 implies an upside of 86% from the current market price. There is a lot of uncertainty regarding Ford’s prospects, and that’s why I have used a discount rate of 9% to find the present value of the company, which is much higher than what I would have used for a company in which I have a higher degree of conviction.

The second quarter will be a difficult one: brace for impact

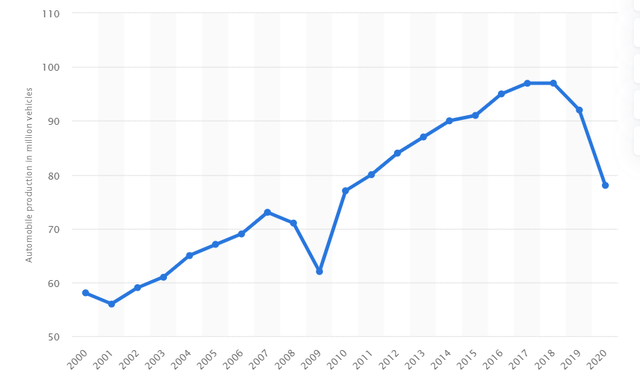

There is a worldwide chip shortage, and to be fair, automakers could not have avoided this catastrophe. Here’s what happened. In early-2020, governments across the world imposed mobility restrictions, and many vehicle manufacturing plants were ordered to shut down. The demand for vehicles declined sharply as well, which was not surprising considering how Covid-19 wreaked havoc in all major economies in the world.

Exhibit 2: Estimated worldwide automobile production

Source: Statista

With business conditions deteriorating fast, automakers did not place any new orders for microchips with fabrication plants. At the time, there was nothing unusual about this decision as a recovery of business conditions was nowhere in sight. All this while, tech companies were buying chips at a record pace to cater to the increasing demand for personal computers, laptops, and even smartphones. Thanks to trillion-dollar stimulus packages introduced by governments and unprecedented monetary policy support, the global economy recovered faster than expected. With this sharp recovery, automakers naturally wanted to increase the production of vehicles, but unfortunately, the demand for microchips already had far exceeded the supply available in the market. Chip manufacturers usually take over 6 months to design new chips, and automakers are still in the back end of the order flow. The shortage in chips is likely to persist at least through the end of this year, and automakers are likely to find the next few quarters very challenging.

In the first-quarter earnings call, Ford management highlighted that this chip shortage will result in a $2.5 billion hit to 2021 EBIT and will cost the company $3 billion of free cash flow. Ford CEO Jim Farley said:

As we share with you today, there are more white waters moments ahead for us that we have to navigate. The semiconductor shortage and the impact to production will get worse before it gets better. In fact, we believe our second quarter will be the trough for this year.

As we move well into the second quarter, Ford stock might take a hit because of the lackluster expectations for the remainder of this year. For this reason, I believe it would make sense to use a dollar-cost averaging strategy to invest in Ford. In any case, if Ford executes its long-term strategy as expected, the stock is very likely to hit new highs.

Takeaway

Ford Motor Company appears to be very attractively priced in the market, and the company is making the necessary changes to its business model to thrive in a dynamically changing macroeconomic environment. Investing in Ford, however, is likely to be suitable for investors with above-average risk tolerance and a long investment time horizon. To mitigate some of the risks involved with Ford, I will only be investing a small fraction of my portfolio in Ford in the hopes of realizing multibagger returns in the next decade.