- Boeing is known as a great company.

- Current stock price looks like a long-term bargain.

- Analysis reveals that it isn’t.

The COVID-19 pandemic continues to devastate families and economies; but with several vaccines now in the final stages of clinical testing, investors are looking ahead to a return to business as usual in the first half of 2021, and surveying the stock market for beaten-down stocks that can be expected to recover.

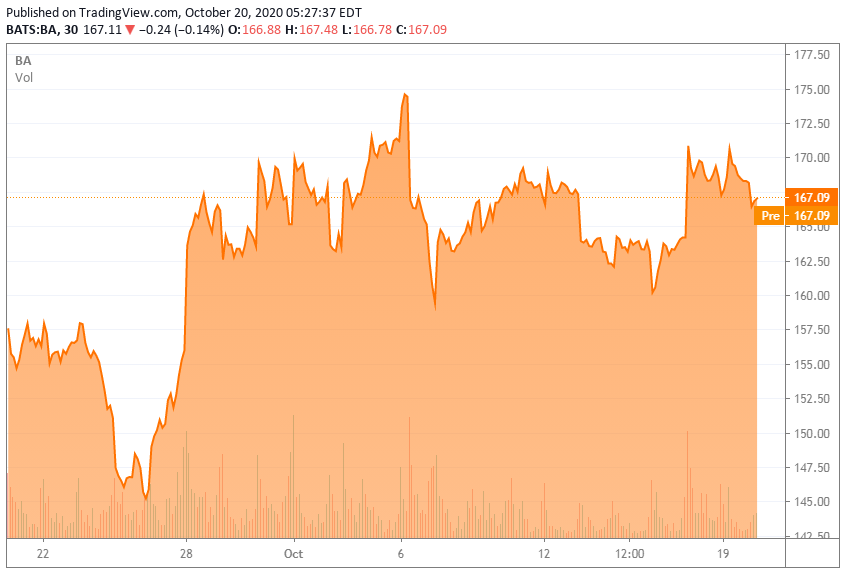

A name I often see in this connection is Boeing (BA). Boeing has been one of the most consistent successes of the US economy for the last fifty years. It has run into trouble lately (need I mention the 737 MAX?) but many investors see it as a long-term winner. Its stock price climbed to over $350/share near the beginning of 2018 and briefly topped $400/share a year later before dropping into a trading range between $340 and $380, until the 737 MAX crashes exposed serious flaws in Boeing’s software-development process. Today it trades between $160 and $170. Isn’t that a bargain? Won’t Boeing fix the software bugs and resume its former strength when air travel returns to normal?

This thinking is wrong in at least three ways.

First, the 737 MAX flaws were not simply software bugs that programmers can fix. They reveal a major shortcoming in Boeing’s entire software development process, because they should have been caught at the specification stage, long before any software programming even started. Development of major components of critical software normally proceeds from a requirements analysis to a detailed specification, with thorough reviews at each stage, before it gets anywhere near a programmer. Getting this kind of development process in place is not easy or quick. Boeing surely had it in the past, but it seems to have allowed it to decay, perhaps owing to commercial pressures to speed up development.

Second, Boeing’s problems did not start with the 737 MAX. Its balance sheet has been a growing disaster area for a couple of years, and the stock was grossly overpriced even before the 737 MAX. Let’s take a look at the balance sheet from its 2019 annual report.