CHICAGO–(BUSINESS WIRE)–Chicago Trading Company, a leading provider of liquidity and pricing on derivatives exchanges around the world, today announced that it has joined the Pyth network , a next generation oracle solution designed to bring real-world data on-chain on a sub-second timescale. CTC will initially publish cryptocurrency prices to the decentralized network and plans to expand into equities as the Pyth network continues to scale.

“Blockchain is fundamentally altering age-old practices and processes like market data services,” said Brett Estell, Global Co-Head of Trading at CTC. “We are excited to join such a strong community of industry leaders to unlock access to market prices in real-time and continue to harness the power of new technologies in the financial markets.”

The Pyth network is built on Solana, a fast blockchain well-suited for timely receipt and distribution of fast-moving data and is also designed to be cross-bridge project working across other leading blockchains. The Solana blockchain can handle 50,000 transactions per second.

“We are humbled by the pace at which the Pyth network is expanding as more industry participants see the value in the network and the potential it could have on our markets,” said Kanav Kariya, Director of Strategic Initiatives, Digital Assets of Jump Trading Group. “Further improvements in decentralized finance require high-fidelity, time-sensitive, real-world data and bringing CTC and other leading firms into the fold brings DeFi one step closer to upending the world of traditional finance.”

About Chicago Trading Company

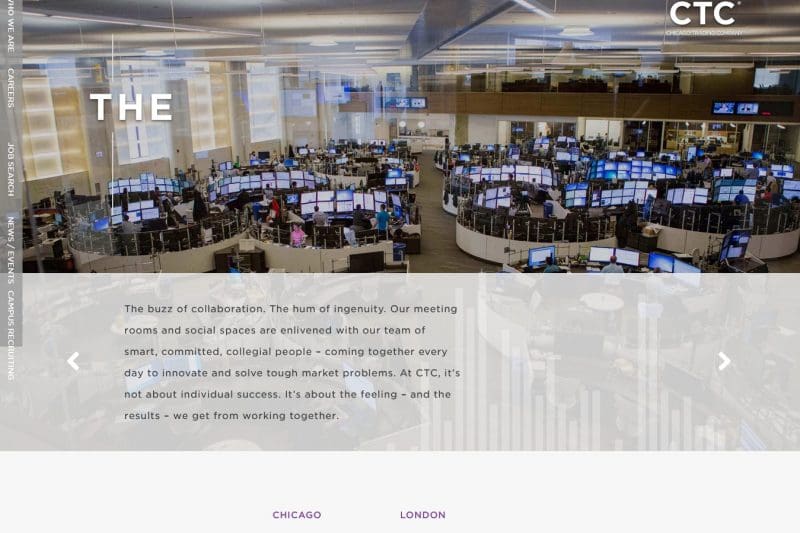

We believe in healthy financial markets. Every day, we deploy our deep expertise to make markets fairer, transparent, and more efficient. Our cross-discipline teams solve difficult market problems across a variety of products and strategies through collaboration, ingenuity, and integrity.

We actively trade in a broad spectrum of asset classes that include Equities, Interest Rates, and Commodities. Recognized as a leading provider of liquidity and pricing on derivatives exchanges around the world, we trade more than 20 hours a day, six days a week. Our success is driven by our mutual commitment and teamwork, coupled with our expertise in pricing and risk management.

We win when we pull together. Our strength comes from the curiosity, ingenuity, and determination each of us brings to work every day. Our competitive advantage comes from our commitment to each other. We’re growing and would love to hear from you if you share these values – you can see our open roles here.

About the Pyth Network

The Pyth network is a specialized oracle solution for latency-sensitive financial data that is typically kept behind the “walled gardens” of centralized institutions. The Pyth network is focused on finding a new and inexpensive way to bring this unique data on-chain and aggregating it securely. For more information about the Pyth network, please visit pyth.network.