Key Points

- Some states impose their own Social Security taxes.

- There are 13 states that tax benefits to some degree.

- Taxes on benefits shouldn’t be the only factor to consider when deciding where to settle down.

Whether your benefits will be subject to federal taxes will depend on what your total retirement income looks like. Generally, if Social Security is your only source of retirement income, you’ll avoid paying taxes on it.

But federal taxes aren’t the only thing you’ll need to worry about once you start collecting Social Security. Depending on where you retire, you may be subject to state taxes on your benefits as well.

Most states don’t tax Social Security

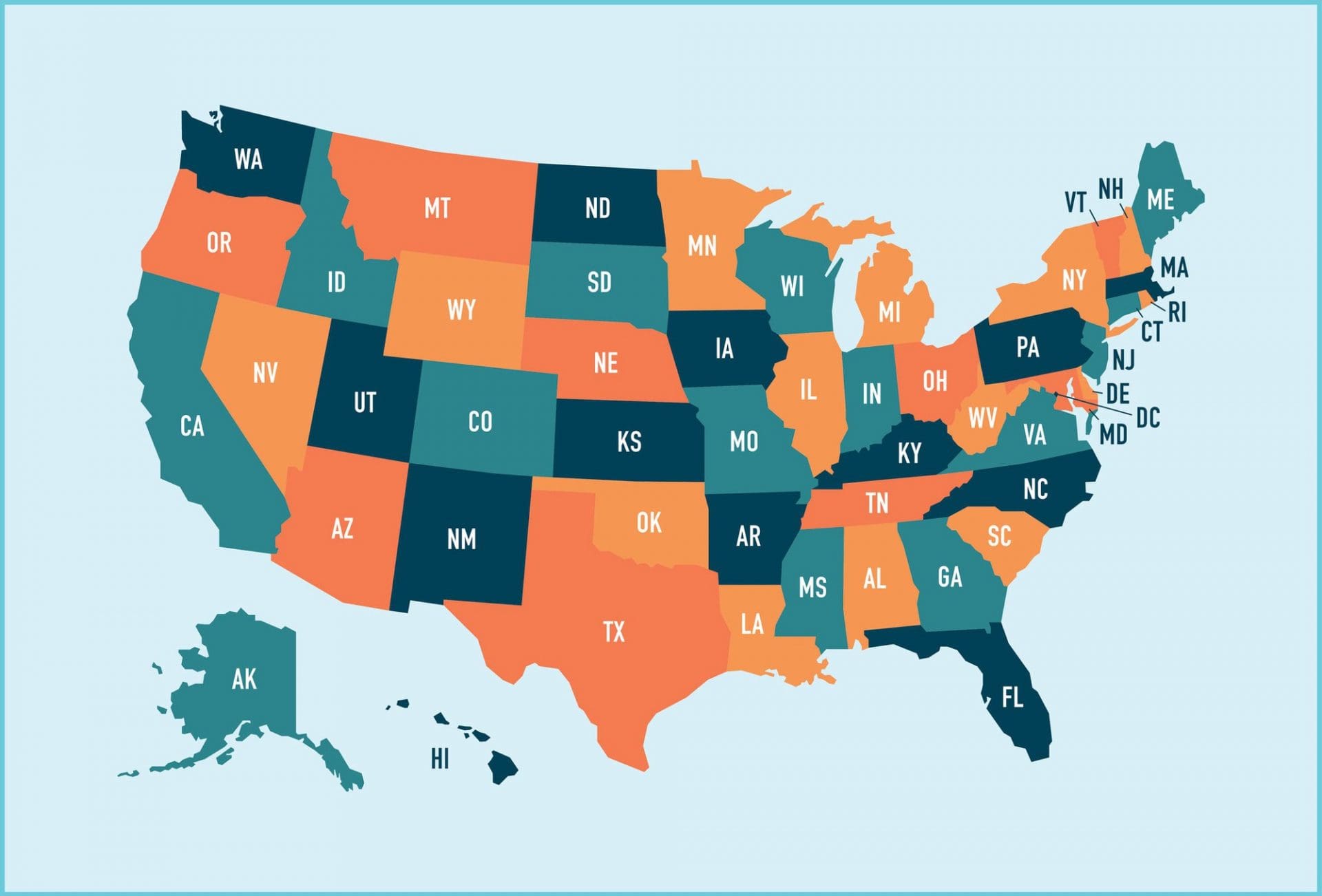

The good news is that right now, there are only 13 states that impose their own tax on Social Security benefits:

- Colorado

- Connecticut

- Kansas

- Minnesota

- Missouri

- Montana

- Nebraska

- New Mexico

- North Dakota

- Rhode Island

- Utah

- Vermont

- West Virginia

This means that in these 37 states, those taxes do not apply:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Mississippi

- Nevada

- New Hampshire

- New Jersey

- New York

- North Carolina

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- South Carolina

- South Dakota

- Tennessee

- Texas

- Virginia

- Washington

- Wisconsin

- Wyoming

Another thing worth noting is that come next year, West Virginia will stop taxing benefits, bringing the total number of states with no Social Security tax to 38.

Should you retire to a state that doesn’t tax benefits?

Avoiding taxes on your Social Security income may be important to you, especially if you expect those benefits to constitute your primary income stream. But before you make a point to avoid those 13 (soon to be 12) states that do tax benefits, there are other factors it pays to look at.

For one thing, look at each state’s cost of living. You may find that while some states do tax benefits, they also offer much less expensive housing and lower living costs on a whole. And those factors may work to your financial benefit in retirement more so than a lack of taxes.

Another thing to consider is that most of the states that do tax benefits offer some type of exemption for lower earners. This means that if Social Security is your primary or sole income source, your benefits may not actually be taxed after all, even if there is a state tax in place.

Do your research

Taxes on Social Security benefits aren’t the sort of thing that should catch you by surprise. It pays to read up on how Social Security works to make sure you understand the ins and outs of your benefits.

Incidentally, it’s easy enough to get an estimate of your monthly benefit well ahead of retirement so you know what to expect. All you need to do is create an account on the Social Security Administration’s website and access your annual earnings statements, which will summarize your yearly wages and give you a sneak peek at your future benefit.

The $17,166 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $17,166 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.