- In November, Madrigal released open-label data from the MAESTRO-NAFLD study.

- This data was positive and could be used to make predictions about the entire study.

- Madrigal is a strong buy at current prices. Insiders should buy their own company’s stock more.

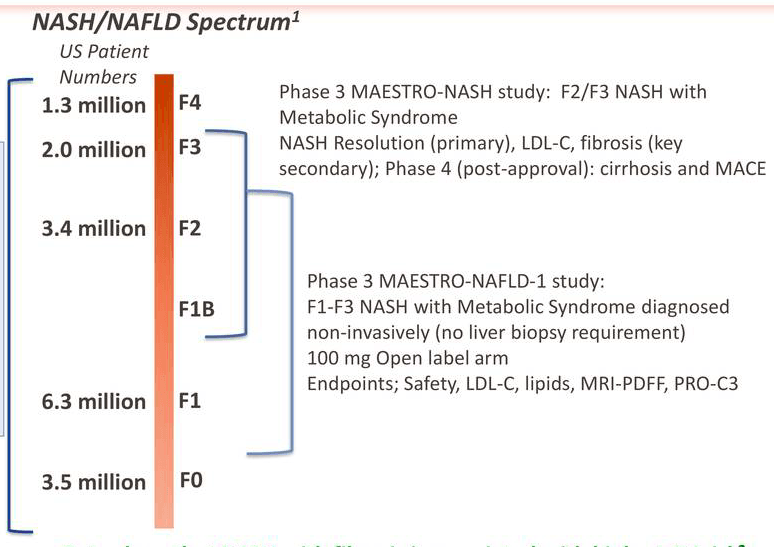

Madrigal Pharmaceuticals is a late-stage biopharma company developing resmetirom, a first-in-class, orally-administered, small-molecule, liver-directed, thyroid hormone receptor (THR)-β selective agonist. The drug targets a specific thyroid hormone receptor pathway in the liver, which is a “key regulatory mechanism common to a spectrum of cardio-metabolic and fatty liver diseases with a high unmet medical need.” The asset is currently in two Phase 3 clinical studies, MAESTRO-NASH and MAESTRO-NAGLD-1, designed to demonstrate multiple benefits across a broad spectrum of NASH (non-alcoholic steatohepatitis) and NAFLD (non-alcoholic fatty liver disease) patients. I have covered Madrigal extensively before.

Madrigal’s main catalyst is the set of two MAESTRO phase 3 trials, one each in NASH and NAFLD. The MAESTRO-NAFLD study, which is a “relatively lighter weight” study of “presumed NASH” patients in what has been termed by the company as a “real-life” NASH study with non-invasive monitoring of patient response, differs from the MAESTRO-NASH study in its selection of patients (less severe NASH, borderline NASH F1-F2 stages), study endpoints, and patient monitoring (biopsy vs non-biopsy). The two studies are best described in the following diagram: