- Newmont Mining just came off a record quarter in Q3 with free cash flow of ~$1.3 billion, and increased its dividend by 60% to $1.60 per share annually.

- Despite these bullish developments, the stock has slumped with the rest of the sector, down more than 20% from its August highs.

- This correction has left the stock trading below 13x FY2021 annual EPS estimates, with a dividend that’s 70% higher than that of the S&P 500.

- Therefore, if we see any further weakness below $57.25, I would view this as a low-risk buying opportunity for long-term investors looking for steady free cash flow and yield.

It’s been a rough few months for the precious metals space (GDX), with the price of gold sinking by nearly 15% and many of the lower-quality miners like Galiano Gold (GAU) being halved during the correction. However, this pullback has also taken a bite out of the leaders, including Newmont Corporation (NEM), which is set to turn 100 years old next May. Despite a quarter of record free cash flow and a generous boost to its annual dividend, the stock has been in a slump since August. This might be discouraging for investors chasing the stock in Q3, but it’s created a buying opportunity for new investors. Based on Newmont’s industry-leading yield and the fact that it’s trading below 13x FY2021 annual EPS estimates, I would view any further weakness below $57.25 as a low-risk buying opportunity.

(Source: JuniorMiningNetwork.com)

(Source: JuniorMiningNetwork.com)

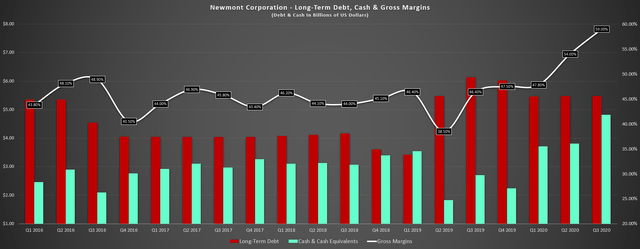

Newmont Corporation reported blow-out results in Q3 with free-cash-flow surging to ~$1.30~ billion, an increase of more than 250% year-over-year (Q3 2019: $0.37 billion). This was driven by a strong increase in revenue growth to $3.17 billion and massive gross margin expansion, with gross margins hitting a new multi-year high of 59.0%. This translated to a 400 basis-point increase sequentially and a more than 1200 basis-point increase in margins year-over-year. Not only has this bolstered Newmont’s balance sheet, with a cash & cash equivalents balance of ~$4.82 billion, but it’s given the company the ability to potentially increase its dividend again next year, with its leverage ratio improving considerably. Let’s take a closer look at the company below:

(Source: Author’s Chart, Company Filings)

(Source: Author’s Chart, Company Filings)

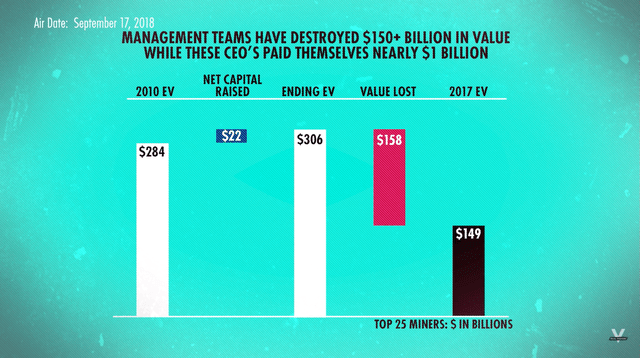

Some investors are quick to write-off gold miners as many gold bugs that have been chanting for $10,000/oz since 2011 have given the industry a bad name. It’s also because the gold miners don’t have a great track record of generating shareholder value, and many are perceived to have a finite supply of resources that could dwindle down in a few years. The former point is absolutely true, with over $158 billion in value destroyed between 2008 to 2018 with poorly-timed acquisitions, massive write-downs, and poor capital allocation in general. Fortunately, this has changed for the better across the sector, which is clear from Newmont’s results. As noted in the Q3 2020 conference call, Newmont is on track to have delivered $2.5 billion to shareholders in 2019 and 2020 alone. Let’s take a look at the second point: