FRANKLIN, Tenn.–(BUSINESS WIRE)–Resource Label Group, LLC, a full-service provider of pressure sensitive label, shrink sleeve and RFID/NFC technology for the packaging industry, today announced it has acquired Seattle-based Labels West, broadening its presence in the Pacific Northwest. Resource Label is a portfolio company of First Atlantic Capital, a New York-based private investment firm, and TPG Growth, the middle market and growth equity investment platform of TPG.

Founded in 1978, Labels West has developed a reputation for providing exceptional customer service and creative solutions for the wine, spirits, health and beauty, food and nutraceutical industries. With more than 40 years in the packaging industry, Labels West offers a diverse portfolio of capabilities including flexographic and digital printing, extended content, tamper evident and promotional label solutions.

Mike Apperson, President & CEO of Resource Label Group, acknowledged, “I am honored that the team at Labels West has joined the Resource Label Group family. Labels West is recognized throughout the industry as a preferred supplier of innovative packaging solutions and we look forward to working together to serve our growing customer base across North America.”

John Shanley, President of Labels West stated, “We are extremely excited to join the Resource Label Group team as they share our commitment to deliver the best possible products and services to ensure our customers’ long term success.”

“The talented team at Labels West has been extremely successful in building top-level customer relationships. They represent another important addition to the Resource Label organization, and we look forward to continued growth.” added Emilio Pedroni, Managing Director at First Atlantic Capital.

Ransom Langford, a Partner at TPG Growth stated, “We are excited to expand our presence in the Northwest. Adding partners such as Labels West continues to support our growth strategy in key markets.”

Labels West represents the seventeenth acquisition for Resource Label Group. This will be their second location in Washington state.

About Resource Label Group, LLC

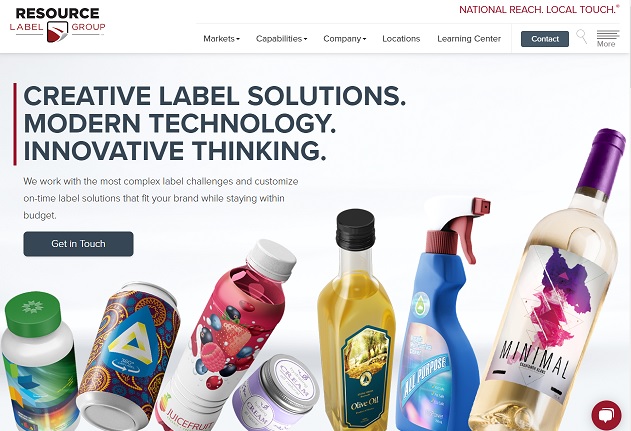

Resource Label Group, LLC is a leading pressure sensitive label, shrink sleeve and RFID/NFC manufacturer with diverse product offerings for the food, beverage, chemical, household products, personal care, nutraceutical, pharmaceutical, medical device, and technology industries. With eighteen manufacturing locations across the U.S. and Canada, Resource Label Group, LLC provides national leadership and scale to deliver capabilities, technologies, systems and creative solutions that customers require. Resource Label is a long-standing portfolio company of First Atlantic Capital, a New York-based private investment firm, and TPG Growth, the middle market and growth equity investment platform of TPG.

Headquartered in Franklin, TN, Resource Label Group, LLC employs more than 1300 associates in the U.S. and Canada. For additional information, visit www.resourcelabel.com.

About First Atlantic Capital

Founded in 1989, First Atlantic Capital is a middle market private equity firm that leverages its extensive consulting and operational experience to acquire middle market companies, seeking to build them up to become market leaders. Since its inception, the firm has completed more than 70 acquisitions assembling 22 successful platforms in various industries that include plastics and packaging, food and beverage, consumer and industrial products and business services. Notable investments in the packaging industry include Berry Plastics, Ranpak, Captive Plastics, C-P Converters, and Resource Label Group. For additional information visit www.firstatlanticcapital.com.

About TPG Growth

TPG Growth is the middle market and growth equity investment platform of TPG, the global alternative asset firm. With approximately $13.2 billion of assets under management, TPG Growth targets investments in a broad range of industries and geographies. TPG Growth has the deep sector knowledge, operational resources, and global experience to drive value creation, and help companies reach their full potential. The firm is backed by the resources of TPG, which has approximately $84 billion of assets under management. For more information, visit www.tpg.com.