- McDonald’s is worth $240 per share, which with the $5.16 dividend included makes for an attractive 18% potential return.

- McDonald’s has excelled at repositioning its business to grow during the COVID pandemic.

- With the pandemic in its final stage, McDonald’s is poised for outsized growth as diners return to the iconic restaurants’ dining areas.

- McDonald’s focus on Digitalization, Delivery, and Drive Thru should help the company continue to grow in this challenging environment.

- Strong restaurant growth in the medium term should boost revenues, as developments that were delayed due to the Pandemic are completed concurrently with planned restaurants for 2021 and 2022.

McDonald’s Corporation (MCD) is an attractive stock as we enter the final stage of the COVID pandemic. The combination of restaurants finally operating near capacity and the company resuming its modest growth plans should move the share price to $240. Adding in the annual dividend of $5.16, investors have the potential to earn nearly 20% on this position over the next year.

The Big Mac for Your Portfolio

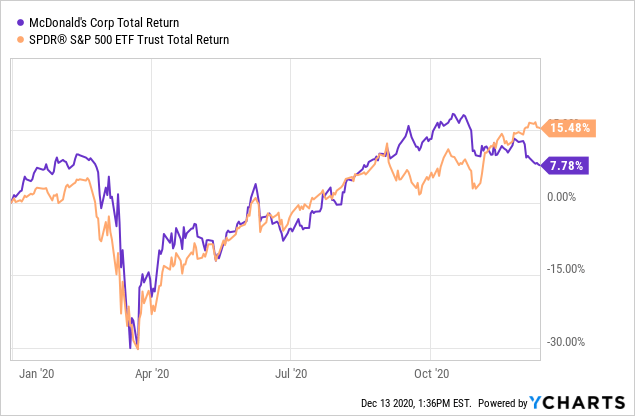

McDonald’s Corporation has been a surprising performer for 2020 as the way we eat, shop, and travel has completely changed. With consumers staying home or very near home for the majority of the year, one would think that restaurants would struggle to remain open, and the share price would reflect this challenge. Fortunately, for shareholders, McDonald’s was able to quickly pivot to support a more restricted diner. Part of this pivot was a result of plans made years ago to create a more digital experience, and part was due to quick thinking from management. The net effect has been a decent year for shareholders with the stock posting positive gains for the year, nearly 8%, compared to almost 16% for the SPDR S&P 500 ETF (SPY).

Year to Date Total Returns for McDonald’s vs. the SPDR S&P 500 ETF

Data by YCharts

Data by YCharts

A large part of the success for 2020 has been due to McDonald’s operating model. McDonald’s is actually more of a real estate company than a restaurant operator. While this has been stated many times, it is worth looking at in detail, especially following a year like this one: