Summary

- T. Rowe Price has performed well over the last 4 to 5 years, including so far through the period of the pandemic.

- A continuation of present P/E levels, and EPS falling within the range of analysts’ estimates, should see solid returns through end of 2023.

- The fallback – even if P/E ratio were to contract to historical levels, low- to mid-single-digit returns are indicated.

- Looking for more investing ideas like this one? Get them exclusively at Dividend Growth Income+ Club. Learn More »

Investment Thesis

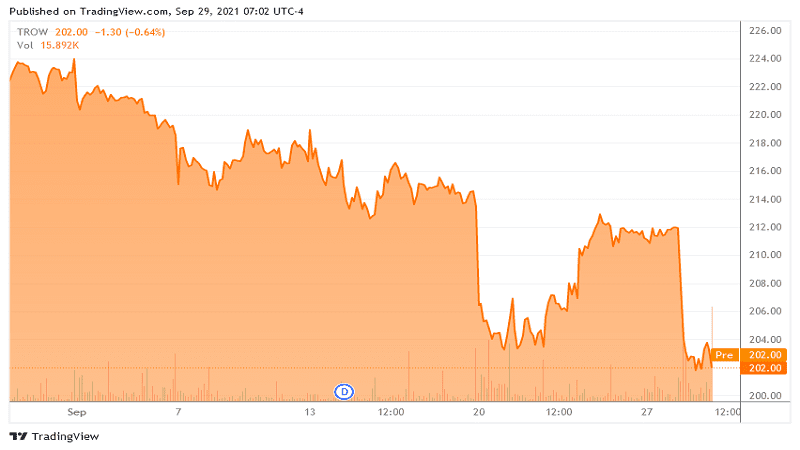

I first alerted my Dividend Growth Income+ Club members to the T. Rowe Price Group, Inc. (TROW) opportunity in an article dated May 12, 2021, exclusive to Club members (May 12, 2021 share price $181.74, current share price $211.22). Since then, on 7 July 2021, the company has paid a special cash dividend of $1.92 per share in addition to its regular quarterly dividend of $1.08 per share. I decided it was time to take another look at prospective returns at the higher current share price.

Running the latest T. Rowe Price Group, Inc. numbers through my structured financial analysis, I come up with indicative total returns for buying at current share price and holding through 2023 of ~2% to 13%. Those returns are based on SA analysts’ EPS estimates being met, and P/E ratio staying within a range from current level of 17.96 to historical average of 15.37. Even if P/E ratio contracted to the historical average, returns are indicated to remain positive ~2% to 7%, provided EPS falls within the range of analysts’ estimates. If sentiment remains strong and TROW’s current P/E ratio is maintained through end of 2023, returns of ~9% to 13% are possible. In summary, T. Rowe Price is not the compelling buy it was back in May, 2021. But the company is performing well and is shareholder friendly, as witnessed by the special cash dividend in July. Any dip in the share price would make for a more attractive buy.

A caveat – I believe there will likely be opportunities in the fourth quarter for lower stock prices across the board, including T. Rowe Price, as I believe a market correction is overdue.