Summary

- COLM announced results that beat analysts’ expectations.

- Management aims at a growth of 18%-20% in 2021.

- Peer comparison shows that COLM is trading at 45% discount to its peers.

- DCF valuation shows a potential upside of at least 24%.

Columbia Sportswear Company (NASDAQ:COLM) recently announced results for FY20. Numbers were obviously worse than previous year, yet they beat analysts’ expectations. In the following article, I will provide an overview of the FY20 results and I will explain why I believe that the current COLM’s stock price of $101.73 (02/12/2021) represents an entry point that can offer a strong upside on the long term.

About Columbia Sportswear Company

Columbia Sportswear is an apparel and footwear company that designs, sources, markets and distributes outdoor lifestyle apparel, footwear, accessories and equipment under the Columbia, Mountain Hardwear, Sorel, prAna and other brands. The Company distributes its products through a mix of wholesale distribution channels, own direct-to-consumer channels (retail stores and e-commerce), independent distributors and licensees. As of December 31, 2019, its products are sold in approximately 90 countries.

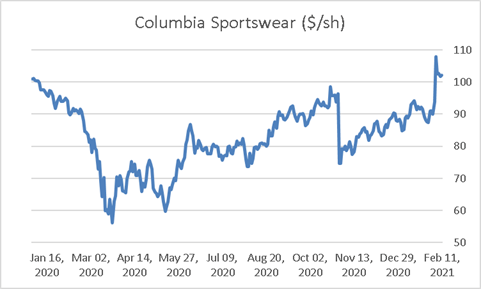

Columbia Sportswear is listed on the Nasdaq: in the last year, the stock has increased by 12.4% with a 52-week range of $51.99 – $112.21.

(Source: Analysis on data from Thomson Reuters)

FY2020 Results

In the context of a challenging 2020 due to the pandemic impact on retailers, Columbia Sportswear’s results are not that bad. All key metrics are worse off than in FY2019, but less than analysts’ expectations.

Net sales decreased 18% to $2.50 billion from $3.05 billion in 2019 with operating income decreasing by 65% to $137.0 million – or 5.5% of net sales – from an EBIT of $395.0 million in the previous year (13% EBIT margin).

Net income declined by 67% to $108.0 million – or $1.62 per share – compared to a net income of $330.5 million, or $4.83 per share, in 2019.

Remarkably, Columbia Sportswear has cash and cash equivalents for $790 million, up from $686 million of the previous year, and has no long-term debt, thus making the Company cash positive.

During FY2020, inventories decreased by 8% from $606 million in FY19 to $556 million.

All the main four brands of the Company saw their revenues declining with Columbia being the most affected (-20% YoY) and Sorel the least one (-7% YoY). Mountain Hardwear and prAna respectively lost 11% and 13%. From a geographical perspective, revenues dropped in all areas with a -20% in Latin America & Asia Pacific (LAAP), -19% in EMEA, -17% in US and -14% in Canada.

FY2021 Outlook

During the FY20 earnings announcement, Columbia Sportswear’s management presented its forecast for the current year. Net sales are expected to increase by 18% – 20% YoY to $2.95 – $3.00 billion, with operating income setting at $320 – $346 million. Therefore, the expected operating margin is somewhere between 10.8% and 11.5%. Earnings per share are forecast at $3.75 to $4.05.

The Company also announced its objective of returning at least 40% of the free cash flow to shareholders through dividends and share repurchases.

Multiple valuation

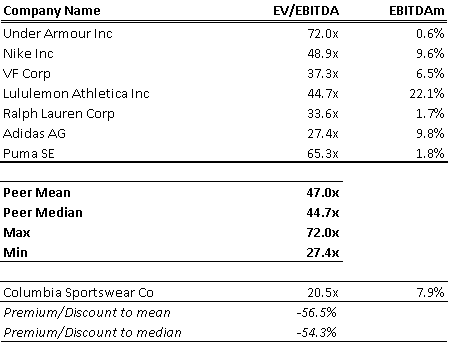

I performed a peer multiple comparison to have a better understanding of the current Columbia Sportswear’s valuation. I identified a set of seven peers including both American and European players: Under Armour, Nike, VF Corp, Lululemon Athletica, Ralph Lauren, Adidas and Puma.

Since not all the aforementioned companies are posting positive earnings, I could not use the P/E multiple. Focusing on the EV/EBITDA, results show that the mean is 47.0x, the median is 44.7x, with the maximum being Under Armour at 72.0x and the minimum being Adidas at 27.4x.

As of 02/11/2021, Columbia Sportswear is trading not only at a huge discount to the mean (56.5% discount) and to the median (54.3%) but also below the minimum multiple.

(Source: Analysis on data from Thomson Reuters)

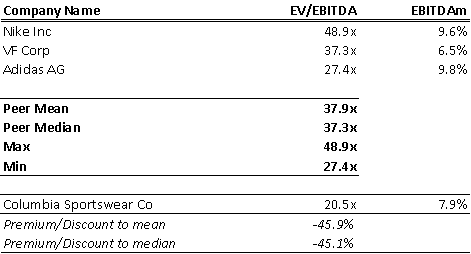

Considered the large discount of Columbia Sportswear to its peers, I decided to perform an additional peer analysis by selecting only those companies with an EBITDA margin similar to Columbia Sportswear’s (7.9%). Therefore, I set a spread of -2%/+2% on the EBITDA margin, and I select the companies that are within the range: Nike, VF Corp and Adidas.

(Source: Analysis on data from Thomson Reuters)

Results still confirm the strong potential upside that Columbia Sportswear’s stock can offer: the stock is trading at 45.9% discount to the mean and 45.1% to the median.

DCF Valuation

Besides a peer-multiple comparison, I also performed a DCF valuation to determine the intrinsic value of the stock. The starting point of the valuation is the 2020 free-cash flow to the firm (FCFF) calculated as the cash flow from operations ($276 million) minus the yearly capex ($29 million): the result is a FCFF of $247 million. From 2021 going forward, I assumed a FCFF growth of 9.8% per year until 2025 and 6.2% per year from 2026 to 2030. These growth rates are aligned with a study from “The Business Research Company” that forecasts the recovery of the apparel market after COVID-19. Considering the large impact that the terminal value has in a DCF valuation, I adopted a cautious approach performing a sensitivity analysis with three different long-term growth rates: case A: long-term growth rate is 0.5%; case B: 1%; case C: 1.5%. Since Columbia Sportswear bears no financial debt on its balance sheet, FCFFs are discounted using the cost of equity, which I assumed at 6.11%, aligned with Damodaran’s forecast for the apparel industry. The results of the DCF analysis are outlined in the following chart.

(Source: analysis on Company data)

(Source: analysis on Company data)

One could notice that, in all three cases, the target price offers a large upside when compared to the closing price of $101.73 (02/12/2021): this should once again confirm the thesis that Columbia Sportswear is a stock that is currently undervalued.

Risks

When looking at Columbia Sportswear, investors should be aware of the most relevant risks connected with the stock. Indeed, being an apparel company implies that Columbia Sportswear is highly dependent upon consumer discretionary spending and brand preference. Moreover, the Company competes with a number of other famous brands – as highlighted in the peer comparison – and is therefore susceptible to potential market share loss.

Conclusion

Columbia Sportswear’s FY2020 was a tough year due to the pandemic, yet the Company managed to soften the impact of lockdown due to COVID-19 and announced results that beat Wall Street’s expectations. The outlook for 2021 is very promising and the potential fading of the pandemic might act as a catalyst boosting financial results. Moreover, the peer comparison shows that Columbia Sportswear is deeply undervalued if compared to its competitors, leaving room for a strong upside. The same thesis is confirmed by the calculation of the intrinsic value through a DCF analysis. That is why I believe the current stock price of $101.73 per share (02/12/2021) is a good entry point for investors seeking to generate a high return.