Summary

- At this point in time, shares of Brandywine Realty Trust are trading at low multiples and the company likely has attractive upside potential as a result.

- It is important to note, though, that shares are priced like this because the company is desperately in need of stability.

- Until we see evidence of that taking place, the company is too speculative for me to like.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

Generally speaking, the REIT space offers attractive opportunities for investors who are interested in significant cash payouts and strong returns over an extended period of time. Having said that, not all REITs are created equally. For instance, one category of REIT that suffered during the COVID-19 pandemic was the office space REIT. Due to social distancing and the growth of remote work, the demand for office space took something of a beating. However, this is not all bad.

For investors who are bullish in this space and who end up being right about that bullish stance, the past several months have likely been a good time to consider buying into this market. One prospect that I was generally bullish on, but only marginally so, is a company called Brandywine Realty Trust (BDN). Recently, however, I have started to become a bit more worried about the firm’s fundamental condition. At the end of the day, shares do still offer attractive prospects. But that is only if the firm can stabilize its operations in the near future. Otherwise, the end result could be further pain for shareholders down the road.

Recent developments are disappointing

The last time I wrote an article about Brandywine was in July of this year. In that article, I came out his bullish about the company. But I warned that in order for it to pay off, stabilization at the firm would be needed. Since then, the company has generated a return for shareholders of negative 0.2%. This compares to the 5.7% achieved by the S&P 500. More likely than not, this lackluster performance, on a relative basis at least, is attributable the market digesting fundamental performance that indicates the worst may not be over for the enterprise.

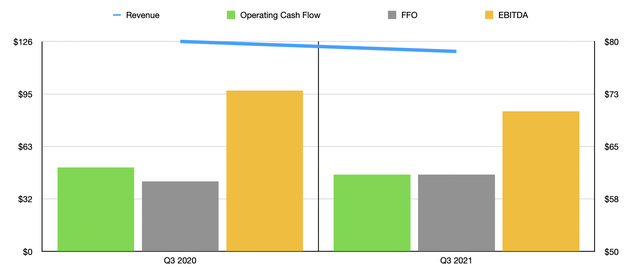

*Created by Author

As an example of this, we need only look at recent financial performance for the company. During the first three quarters this year, the company generated revenue of $361.29 million. That represents a decrease of 11.5% compared to the $408.03 million the company generated the same time a year earlier. This decrease actually came despite the fact that the year to date occupancy rate, of the company remained flat at 90%. For the third quarter alone, however, occupancy was 90.2%, down from 90.7% a year earlier. For the third quarter, revenue came in at $120.42 million compared to the $126.11 million seen in the third quarter of 2020.