Key Points

- Many seniors rely heavily on Social Security in retirement.

- Most states won’t impose taxes on that income.

- Even if you move to a state that taxes benefits, there are steps you can take to compensate.

Social Security is another income source that can be taxable — but not always. At the federal level, taxes on benefits apply to seniors with moderate income or higher. And often, those federal taxes are hard to avoid.

But steering clear of Social Security taxes at the state level isn’t as difficult. That’s because most of the 50 states don’t impose a tax on benefits, and moving to the right state could help you keep more of that money for yourself.

States that don’t tax Social Security

Some states don’t have an income tax at all. As such, Social Security benefits can’t be touched. But there are plenty of states that charge income taxes but still leave Social Security alone.

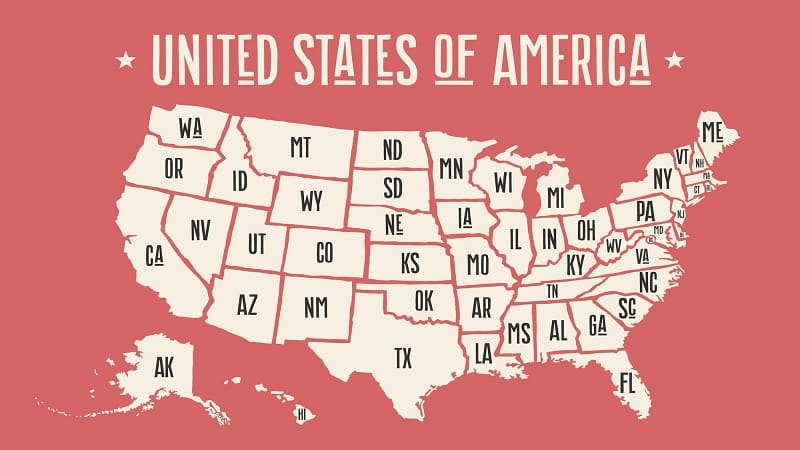

If you retire in one of these 37 states, you won’t have to worry about your benefits getting taxed at the state level:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Mississippi

- Nevada

- New Hampshire

- New Jersey

- New York

- North Carolina

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- South Carolina

- South Dakota

- Tennessee

- Texas

- Virginia

- Washington

- Wisconsin

- Wyoming

Should you avoid states that tax benefits?

It’s easy to see why seniors would prefer to avoid having their Social Security income taxed at the state level. But it’s also important to realize that some of the states that tax benefits offer other perks, like a general low cost of living and a moderate climate.

Furthermore, you may have the goal of moving closer to your family once you retire. And you shouldn’t necessarily let the idea of state-level Social Security taxes stop you from doing that.

For one thing, many of the states that tax benefits also offer exemptions for low and moderate earners. Secondly, there are other steps you can take to lower your overall tax burden in retirement.

For one thing, you can house your retirement savings in a Roth IRA or 401(k). While your contributions to one of these accounts won’t score you a tax break, withdrawals will be yours to enjoy tax-free as a senior.

You can also invest in a manner that limits your tax liability. Loading up on municipal bonds, for example, is a good way to secure an income stream of interest payments without being liable for federal taxes. And if you buy municipal bonds issued by your state of residence, those interest payments are exempt from state and local taxes, as well.

Therefore, while it’s good to be aware of which states do and don’t tax Social Security, you don’t necessarily need to make drastic changes to your retirement plans because of that. Even if you do end up losing some of your benefits to state taxes, there are steps you can take to compensate.