Summary

- Ciena maintains its market leadership with a long-term goal of improving free cash flow and operating margin against its peers.

- Secured meaningful partnerships and acquisition that will drive top line growth.

- Enjoys a positive outlook for both short and long term from its management.

- Reduced concentration risk while maintaining a growing top line.

- Ciena is trading cheaply at 2.78x Price/Sales ratio and is heading towards near its inflection point.

Trevor Meunier/iStock Editorial via Getty Images

Ciena (NYSE:CIEN) is one of the leading providers of network infrastructure solutions for telecom, datacenter, and cloud environments. Their innovative product portfolio solidifies their market leadership and is on track to give their shareholders a growing top line, better margins, and more free cash flow. It is well positioned to benefit from a booming digital transformation and to contribute to the solution toward automation, which will transform how people live. Ciena has been able to grow its asset base while deleveraging, and currently trades at a reasonable 20.35 times earnings.

Surpassing Management’s Expectations

The management began the latest earnings call by expressing extreme optimism about the company’s performance. CIEN reported a revenue growth of 2.5 percent year over year, exceeding their expectations, as did the company’s gross margin of 48 percent and adjusted operating margin of 16.8 percent.

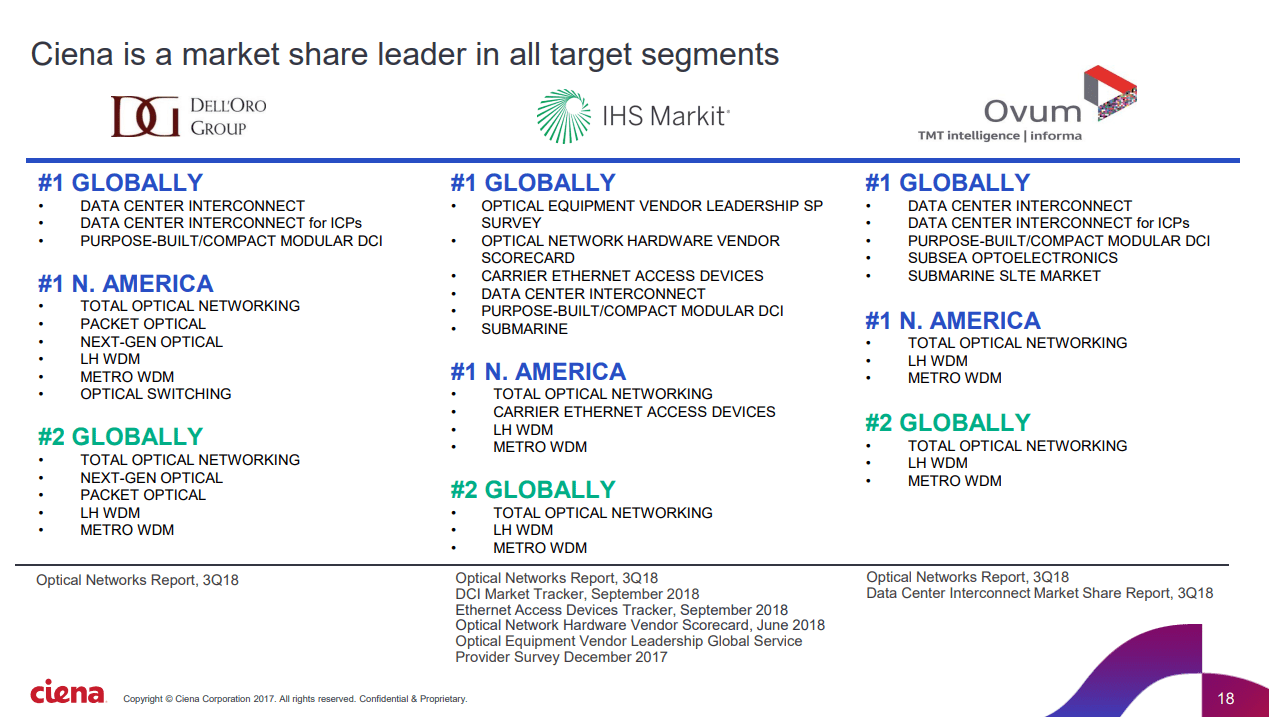

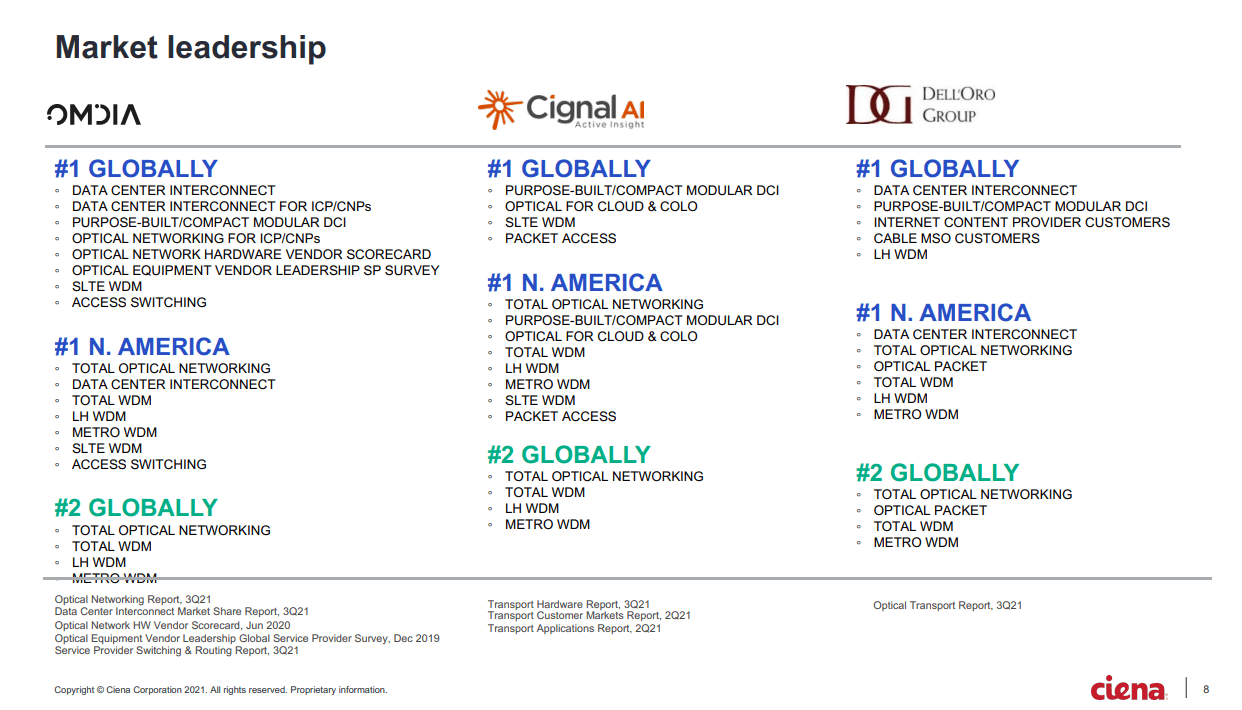

Securing Market Leadership: 2018 vs 2021

Ciena has maintained its market leadership position since 2018 and will continue to be a market leader for years to come. It continues to form beneficial partnerships, like those with Vodafone Idea Limited and Samsung (OTC:SSNLF), as well as its recent acquisition of AT&T‘s (T) Vyatta Routing and Switching Technology; such ventures position the company well to capitalize on opportunities associated with its identified six megatrends, as illustrated in the image below: