Summary

- CBRE has navigated through FY12/2020 by generating record-high free cash flow and maintained flat revenues YoY.

- The company’s diversification over property types, lines of business, and clients has demonstrated its resilience, and it is now positioned for a robust recovery profile into FY12/2021.

- The shares are trading on a current free cash flow yield of 4.0% which is attractive. We are buyers of the shares.

Investment thesis

Trading on a current free cash flow yield of 4.0%, we believe CBRE’s (CBRE) shares are attractive. We expect softness to remain in the office market YoY, but the company’s diversified business exposure should result in a robust recovery overall.

Quick primer

With historic ties going back to 1906, CBRE is the largest global commercial real estate services and investment firm in terms of revenues. Around 40% of revenues is derived overseas.

Our objectives

CBRE reported stronger than expected Q4 FY12/2020 results. In this we want to assess the following:

- How the company was able to navigate through the pandemic effectively.

- The outlook for a sustained recovery into FY12/2021.

We will take each one in turn.

Diversification is the key

We will start with the conclusion here first. CBRE was able to book flat revenues YoY for FY12/2020 and adjusted EPS declining 12% YoY, primarily as a result of a diversified business spanning property types, lines of business and clients.

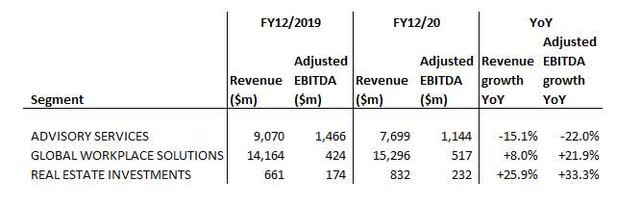

Segment revenue and adjusted EBITDA

Source: Company, created by author

Out of the three core business segments, the most at-risk was the most profitable Advisory Services due to its prevalent non-recurring and deal-driven nature. Here FY12/2020 sales declined 15.1% YoY despite a visible drop in office sales and leases, offset by exposure to industrial and multi-family property.