Following a successful inaugural tax season, April (April Tax Solutions Inc.), a personal income tax platform that embeds into digital financial apps, announced today that it has raised $30M in a Series A Round. The fast-growing fintech startup has gained the attention of unicorn founders and leaders in the space, with backing from Treasury, a fintech infrastructure focused fund established by the founders of Betterment and Acorns.

In addition to Treasury, the round included participation from notable tech investors and financial leaders such as QED, Nyca Partners, Team8, Euclidean Capital and Atento Capital. The company has raised $40M since its launch in January 2022.

With $204B in overpayments returned to Americans this year and an increasingly complicated tax code, embedded tax promises to be the next essential area for disruption, and April is leading that charge. Launching at the beginning of 2022, April served thousands of American taxpayers through partnerships with several financial institutions. Propel, a mission-driven fintech company, used April’s tax platform to help its members file quickly and access their tax refunds. It took April users an average of 15 minutes to file their tax information, with 90% filing on mobile devices.

“We’re proud to partner with April as one of the few startups focusing on how to make taxes easier for everyday Americans,” said Jimmy Chen, Founder and CEO of Propel. “There’s a major financial opportunity for the segment of Americans we serve to have access to the funds they need and help them put food on the table.”

April’s tax engine enables fintechs to perform tax calculations throughout the year, as data emerges. By embedding directly into a user’s banking app or website, April is able to proactively fill most information needed for tax filing, saving users time and money without adding on extra costs throughout the process.

April was co-founded by Ben Borodach, a former Deloitte fintech strategist who led corporate strategy for venture group Team8, and Daniel Marcous, the former CTO of the navigation startup Waze, which sold to Google for $1B in 2013, who later served as a lead data scientist at Google in Israel. Borodach and Marcous met through Team8 where they incubated the company. The co-founders have onboarded a team of 30 including renowned CPA Jody Padar, also known as “The Radical CPA,” to head April’s tax group.

“April’s main goal is to empower the taxpayer,” said Borodach. “By embedding tax into the banking and financial apps that folks are already using, we can drastically reduce the tension of tax filing, helping American taxpayers avoid overpayments and attain a better grasp on their overall financial picture, with the full power of the tax code at their disposal.”

April will use the new funding to expand its R&D capabilities and increase operational capacity in preparation for next tax season. “Tax is a logical extension of the modern consumer finance experience and April is well positioned to assist fintechs in bringing this capability to market,” said Jeff Cruttenden, who led the round from Treasury and previously co-founded Acorns and Say Technologies.

As part of the funding round, Lowell Putnam, a seasoned fintech infrastructure entrepreneur, will join April’s Board of Directors. Putnam was the founder of Quovo which later sold to Plaid. “Lowell’s experience pioneering modern fintech infrastructure will be invaluable to guiding April into our next phase of growth,” said Borodach.

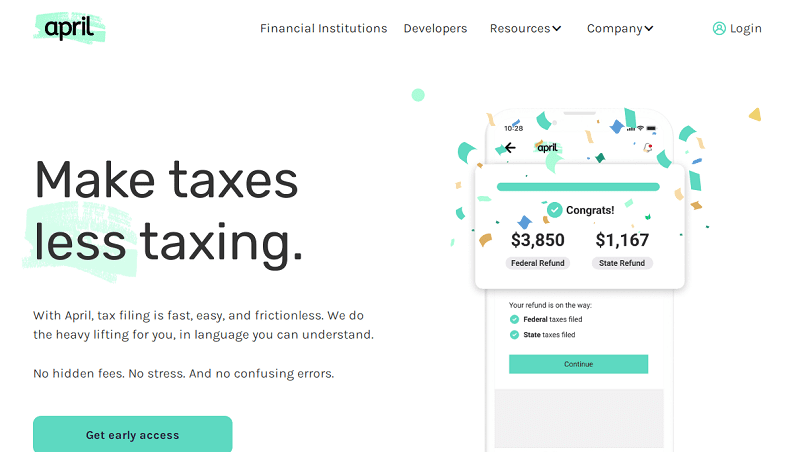

April is an intelligent tax platform that offers a fast, frictionless and rewarding tax experience. April automates the tax filing process, optimizes tax refunds and provides users with personalized, actionable tax insights to help them make smarter financial decisions all year round. April’s tax engine can be embedded into any third-party platform to help fintech companies and financial institutions broaden their offerings to include tax-as-a-service, and better serve clients across their ecosystem. Learn more at Getapril.com.

Treasury is the fintech venture firm led by Eli Broverman (founder of Betterment) and Jeff Cruttenden (founder of Acorns and Say). Treasury supports financial technology companies globally. The firm is based in NYC.