Diamond Standard, a New York-based developer of regulator-approved diamond commodities, raised $30M in Series A funding.

The round was led by Left Lane Capital, and Horizon Kinetics, with participation from Gaingels and Republic.co.

The company intends to use the funds to increase capacity and expand its offerings.

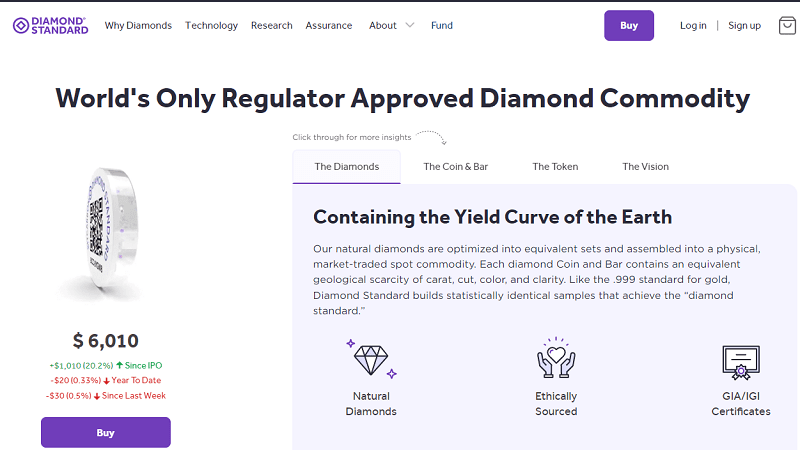

Led by CEO Cormac Kinney, Diamond Standard helps investors to access a natural resource currently worth $1.2 trillion – more than all the world’s silver and platinum combined. A hard asset that can be transacted as a blockchain token, the diamond commodity provides diversification, potential inflation protection, and a new store of wealth for institutional and individual investors, while bringing transparency and efficiency to the diamond supply chain.

The raise follows the launch of the Diamond Standard Fund, enabling investors to allocate to a new asset class – diamonds – through convenient shares, rather than holding physical diamonds directly. In September 2021, the firm announced a new headquarters in New York diamond district and located near the Gemological Institute of America (GIA). Last year, it also announced agreements to develop diamond futures offered by MGEX™ via the CME Globex® platform, and options via MIAX™.