Summary

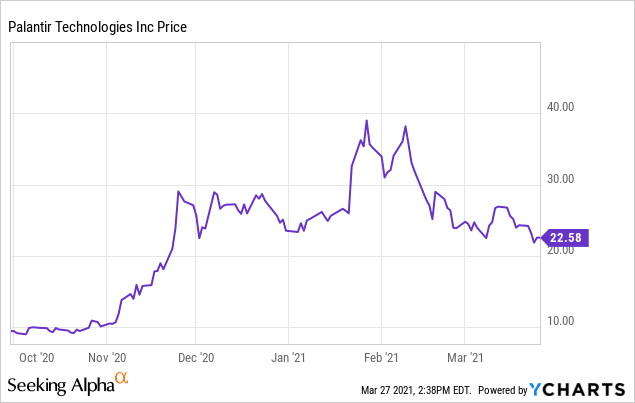

- Palantir has been the subject of a very painful correction over the past two months, taking the stock down 50% below recent highs.

- The sharp decline is all sentiment-driven: the company’s fundamentals continue in strong shape.

- Growth at scale is one of the main reasons to continue believing in Palantir: despite being at a >$1 billion revenue scale, Palantir is projecting 45% y/y growth in Q1.

- Palantir’s traction among its commercial clients is also picking up, with 2x y/y growth in 2020.

- I do much more than just articles at Daily Tech Download: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

I’ve had a bit of a short roller-coaster with shares of Palantir (PLTR), among the most highly anticipated and hyped IPOs of 2020. The data analytics and machine intelligence company, widely credited for helping the U.S. government track down Osama bin Laden, has been a very speculative and volatile trade in the tech sector. Surprisingly it wasn’t popular on the day of its IPO, and I managed to snag a position at sub-$10 (back then, investors were chiefly worried about the fact that insiders weren’t restricted from selling their shares, and news of sizable insider transactions scared off bulls).

Then Palantir began a breathtaking rally that at one point took it to the mid-$30s, and I began to de-risk my position in the high $20s, on the basis that Palantir shares – despite continued strong performance – had hit an incredibly high valuation and had risen too far, too fast. Now, the opposite is true in reverse: Palantir has fallen too far, too fast (with shares down ~50% from all-time highs in the ~$40s and down -3% for the year), and I think there is a ripe opportunity to buy into this stock for a rebound.

To be clear, I don’t think of myself as a short-term trader. I typically like to hold onto high-quality companies for the long haul, but my decision to let go of Palantir earlier this year was based on my hunch that I’d be able to get back into the stock at a better price. And I think that opportunity has struck now.

There are a number of reasons I continue to be bullish for Palantir’s future, beyond the fact that its recent crash is unexplained by the strong fundamentals it has posted through Q4. Among the biggest drivers of the bullish thesis for this stock:

- Terrific execution and growth at scale in a >$100 billion market. Palantir is growing closer to 45% y/y despite reaching a >$1 billion annual revenue scale. Palantir estimates its total addressable market at $119 billion – which would indicate that the company is still only 1% penetrated in its overall space.

- One foot in the public sector, one foot in the private. Palantir’s array of software products cover a roughly equal revenue split between government and corporate clients, with massive expansion opportunities in both. Federal use cases keep expanding: Palantir’s government business has continued to balloon ever since a 2018 court ruling that federal agencies, including the U.S. Army, had to evaluate “commercially available” technology solutions before attempting to develop them in-house. The company has also recently signed deals with the HHS related to tracking of the vaccine rollout.

- Best-of-breed technology leadership. Palantir is widely regarded as one of the most advanced companies in AI and big data analytics, a space that will only continue to receive more attention as time goes on. This technology has so many applications that it’s feasible to see Palantir growing at a 20-30% pace for years to come.

- Use cases are infinite. AI/analytics are a rather unique space in software in that their use cases are unlimited. A CRM only comes with the purpose of tracking and selling. An analytics platform, however, is the foundation that can feed thousands of different types of applications. This is why Palantir has found success in both public sector and private users.

A quick valuation check: even after Palantir’s harrowing correction, it would be false to claim that Palantir is now “cheap”. The reality, however, is that Palantir is now relatively much cheaper than it used to be.

At current share prices near $23, Palantir has a $41.15 billion market cap (still far from the tech mega-caps, we note), and after netting off the $2.01 billion of cash and $198.0 million of debt on Palantir’s most recent balance sheet, its enterprise value is $39.33 billion.

At present, consensus is calling for $1.48 billion in revenue in the current year (FY21) and $1.94 billion in revenue for FY22, representing 35% y/y and 31% y/y growth, respectively. Considering Palantir is calling for 45% y/y growth in Q1, there’s likely a degree of conservatism to these results. Nevertheless, this puts Palantir at 20.3x EV/FY22 revenue – again, not cheap, but considering software heavyweights have traded previously in the 30-40x range (Snowflake (SNOW) is one prime example), I don’t view Palantir’s valuation to be a limiting bound.

I think the best move is to take advantage of the sharp, sudden correction in Palantir to build on (or in my case, restart) a long position.

Q4 download

Let’s now go through Palantir’s most recent quarterly results in greater detail. The Q4 earnings summary is shown below:

Figure 1. Palantir Q4 results Source: Palantir Q4 earnings release

Source: Palantir Q4 earnings release

Palantir’s fourth-quarter revenue jumped 40% y/y to $322.1 million, dramatically outpacing Wall Street’s $301.1 million expectations, which would have represented only 31% y/y growth. As previously mentioned, Palantir expects growth to further accelerate to 45% y/y in Q1, and for overall FY21 revenue to clock in at “greater than 30% y/y growth”, for which consensus is currently calling for 36% y/y growth.

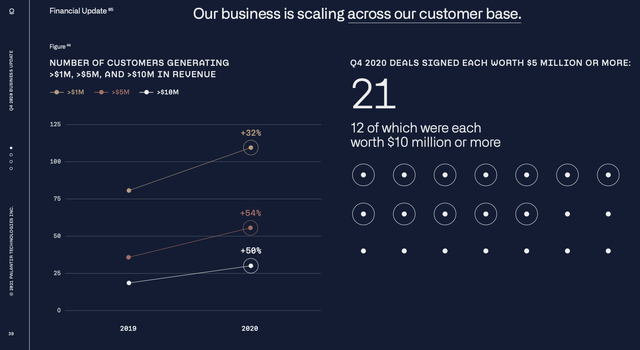

Figure 2. Palantir customer momentum Source: Palantir Q4 investor presentation

Source: Palantir Q4 investor presentation

Palantir is growing through a combination of both “land” and “expand.” The biggest “land” opportunity for Palantir is in the commercial space, where the company’s 107% y/y growth in U.S. corporate clients for the whole of 2020 outpaced 77% y/y growth in U.S. government revenue. Major clients landed in Q4 include global giants Rio Tinto (RIO) in the materials sector, as well as PG&E (PCG) in the energy sector – again highlighting the potential diversity of use cases for Palantir across different industries. And as we note in the slide above, Palantir signed 21 deals worth $5 million or more in Q4 alone, of which half (12) were worth north of $10 million. We note as well that the number of customers generating >$1 million, >$5 million, and >$10 million in revenue has grown 32% y/y, 54% y/y, and 50% y/y, respectively – showcasing the continuing tendency for customers to expand their relationships with Palantir over time.

On the government side, Palantir made major progress on a deal with the U.S. Army called “Project Vantage.” Project Vantage is a multi-year deal to help the Army install systems to facilitate data-driven decision making. The multi-year deal spans just shy of $500 million for the total price tag, and in December 2020 the Army confirmed it would award Palantir $110 million for the first year of this contract.

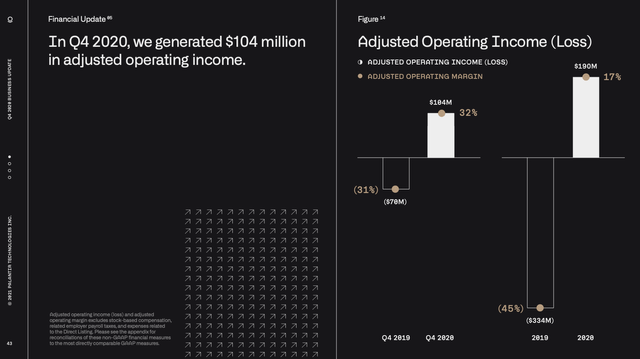

We note as well that while Palantir isn’t fully baked on the profitability side, it is making large strides. In FY20, the company generated 17% adjusted operating margins (32% in Q4 alone), which is sharply higher than deep losses in the prior year. The company has also guided to 23% adjusted operating margins in Q1. Palantir’s scalability is supported by a large gross margin (81% pro forma gross margins in 2020, up ten points versus the prior year) – and especially as the company’s mix of commercial clients increases (where products are more uniform and require less custom creations), we should expect Palantir to continue scaling up its bottom line.

Figure 3. Palantir adjusted operating margins

Source: Palantir Q4 investor presentation

Key takeaways

There’s a huge opportunity to swoop into Palantir at its new lower price. Looking long-term, the potential for Palantir to grow into a tech mega-cap is enormous. Few companies are as advanced in machine intelligence and AI as Palantir is, and this expertise is foundational to the next “step function” of technological advancement. Stay long here.