Summary

- Ford suspended its dividend in 2020 during the early stages of the pandemic, although we believe it will be in a position to restore the payout later this year.

- The company is benefiting from an ongoing turnaround plan including a focus on electric vehicles that is set to drive profitability higher.

- We are bullish on Ford that has gained operating and financial momentum supporting a more positive long-term outlook.

- Looking for a portfolio of ideas like this one? Members of Conviction Dossier get exclusive access to our model portfolio. Learn More »

Ford Motor Company is undergoing a renaissance of sorts supported by a strategy refresh and restructuring plan put in place over the past few years. The company is consolidating its automobile lineup to focus on areas of strength while taking an all-in approach towards electric vehicles which is set to define the business going forward. Despite a challenging environment in 2020 due to the pandemic which forced the company to suspend its dividend, shares of Ford have gained momentum and are up 40% year-to-date. Expectations for an acceleration of global growth along with strong recent trends in automobile sales are supporting a positive outlook. We are bullish on Ford and believe investors can look forward to a potential dividend reinstatement later this year.

(Seeking Alpha)

Does Ford stock pay dividends now?

Ford suspended its dividend in March of 2020 in a decision that was made at the height of uncertainty regarding the coronavirus pandemic. At the time, the company was focused on preserving its balance sheet with a series of efforts including shutting down manufacturing facilities while drawing down on credit lines.

Ford saved about $2.4 billion in cash last year by not distributing the quarterly dividend of $0.15 per share. The action came as a disappointment for investors as Ford had been seen as an attractive income stock with shares yielding about 6.5% before the dividend cut. It’s worth noting that Ford was not alone in making the decision. Given the circumstances, data shows about 60 S&P 500 companies taking similar steps last year by cutting or suspending their shareholder payouts. While some companies have already restarted the payouts, no official announcement from Ford has been made on the timing of a potential reinstatement.

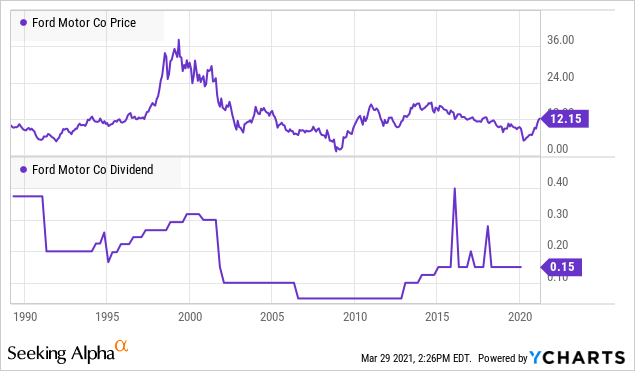

Ford stock dividend history

Ford’s long-term dividend history is mixed considering a previous suspension between 2006 and 2011, along with an inconsistent pattern of hikes and rate cuts going back 30 years. Indeed, shares of the stock have also been volatile over this period, essentially stuck in a relatively tight trading range over the past decade while underperforming the broader market. Before the dividend suspension in 2020, the company had been paying a $0.15 regular dividend rate since 2015 along with an additional “special dividend” in 2016, 2017, and 2018.

The explanation for the volatile dividend trends and weak share price performance historically reflects the continuously changing automotive industry landscape and Ford’s constant efforts to evolve and maintain the market share. To Ford’s credit, the company is both a survivor with a storied legacy while continuing to lead on innovation. A key point here as we discuss below is that a lot has changed in just the past year and we make the case that the outlook for Ford is now stronger than ever.

An ongoing turnaround with a focus on EVs

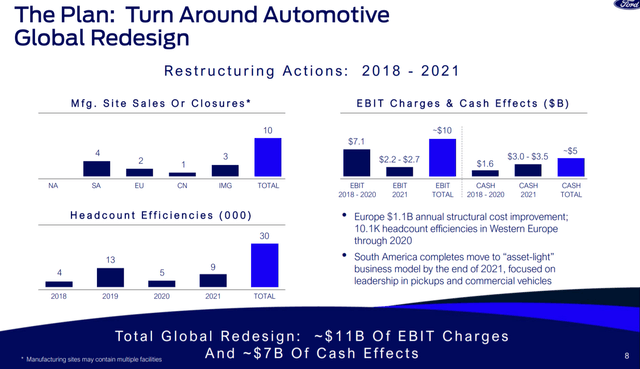

Getting past the dividend history that leaves a lot to be desired, we believe Ford still maintains a solid investment profile and can make a good dividend stock going forward. The setup here is an ongoing restructuring and global redesign in the business that began back in 2018. Citing market trends, the company decided to effectively exit the passenger sedan car market to instead focus on pickups, SUVs, and commercial vehicles which are a more vibrant and profitable market segment. The shift includes the closures of 10 global manufacturing sites while reducing headcount by over 30,000 including plans for further cuts this year.

(source: Company IR)

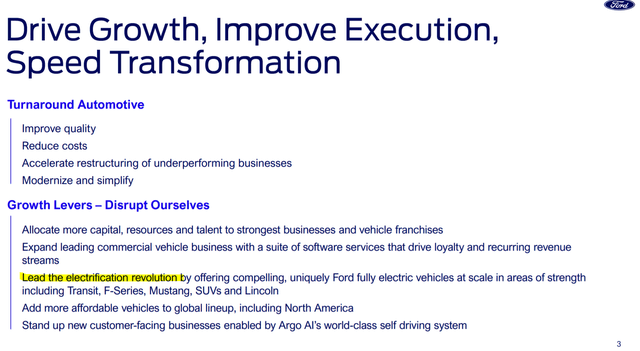

The goal is to streamline into an “asset-light” business model focused on areas of strength to drive margins and profitability higher. The company is shifting investments towards electric vehicles while modernizing and simplifying the entire portfolio. The company’s first fully electric vehicle in the “Mustang Mach-E” is already on sale with strong early momentum and recognized as a competitor to Tesla Model 3 and Model Y. The company plans to roll out more EVs and plug-in hybrids over the coming years. In Europe, a region that represents 20% of firm-wide sales, Ford is targeting 100% of passenger vehicle sales to be EVs by 2030 highlighting the commitment.

(source: company IR)

Ford Financials Recap

Even with a challenging operating environment last year, the results of Ford’s turnaround plan appear to be working. The combination of cost savings initiatives and efficiency efforts implemented last year as a response to the pandemic has helped support the financials with continued positive cash flows and an outlook for improving profitability.

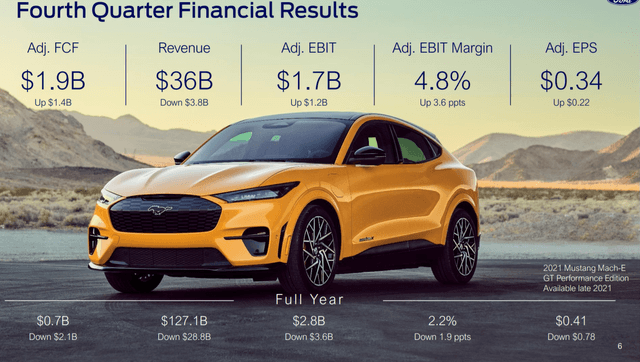

Ford reported its Q4 earnings on February 4th with non-GAAP EPS of $0.34 which beat the consensus estimate by $0.43. Even as automotive revenues at $33.2 billion were down by 9% year-over-year, the company was able to generate a higher adjusted firm-wide EBIT margin of 4.8%, up from 1.2% in the period last year based on higher pricing and lower structural costs.

The company generated $1.9 billion in adjusted free cash flow, up from just $0.5 billion in the period last year. While the full-year results were more impacted by more pandemic disruptions between Q2 and Q3, the company was able to close out the year with a positive adjusted free cash flow of $0.7 billion and adjusted EPS of $0.41 for 2020.

(source: company IR)

Comments from management projected optimism for the year ahead, while also disclosing an even greater push towards the theme of “electrification”. The company now plans to invest at least $22 billion towards its EV infrastructure through 2025, nearly double the previous guidance closer to $12 billion. This is in addition to a separate $7 billion the company is investing towards autonomous driving over the next decade to gain a leadership position in the emerging technology.

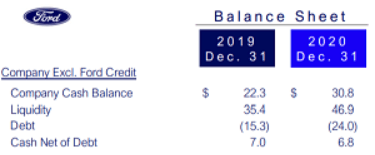

Ford ended the fiscal year with total liquidity of $46.9 billion between $30.8 billion in cash and $16.1 billion marketable securities, up from $35.4 billion at the end of 2019. Against the reported automotive segment debt of $24 billion, the company’s net cash position at $6.8 billion is approximately flat compared to last year which is encouraging amid the pandemic challenges.

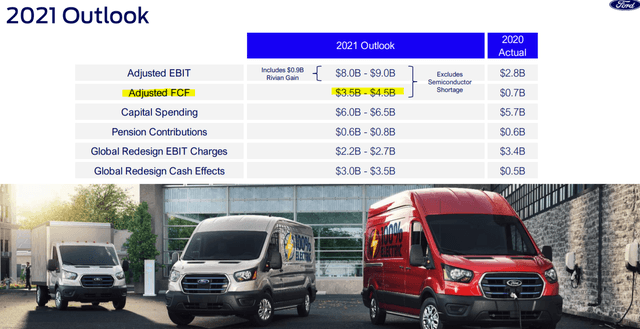

(source: company IR)

More favorably is the outlook and guidance from management suggesting firming financial conditions going forward. For 2021, Ford is targeting adjusted EBIT between $8.0 billion and $9.0 billion, which if confirmed would represent a significant increase compared to $2.8 billion in 2020 and $6.4 billion in 2019. Similarly, the 2021 guidance for free cash flow at $4.0 billion at the midpoint is also well above the $0.7 billion 2020 amount. The results should further improve the balance sheet and liquidity position while adding flexibility to the company’s strategic options.

(source: Company IR)

The latest data shows an ongoing recovery through the last reported Q4 highlighted by improving macro conditions and strong automobile sales globally. Automotive industry market research group “J.D. Power” notes that global light-vehicle sales in December posted a record run-rate of 91.6 million units and up 2.5% year over year. J.D. Power forecast global auto sales to climb 11% in 2021.

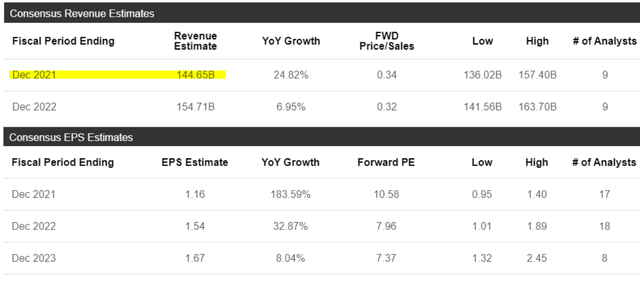

According to market consensus expectations, Ford is forecasted to reach $145 billion in revenues this year, representing a 25% increase from 2020. The EPS estimate of $1.16 compares to the adjusted EPS result of $0.41 in 2020 and $1.19 in 2019. Looking ahead, the view is that the momentum can continue with revenues climbing 7% in 2022 while EPS reached $1.54 as global operating conditions improve through 2021 setting 2022 up for a breakout year under normalized operating conditions.

(Seeking Alpha)

The takeaway from this management guidance and the consensus estimates is that Ford is on track to reach record sales and earnings over the next two years through an accelerating growth outlook. By focusing on the company’s core strengths while exiting low-margin segments, Ford is transitioning into a more profitable company with a stronger long-term outlook.

Would Ford be a good dividend stock?

Circling back to our original point, we are looking at the data above and see a clear path for Ford to reinstate its dividend this year. Our take is that the company likely has the financial capacity to pay a regular dividend immediately, but it’s more likely the board of directors responsible for setting the dividend policy will wait towards the second half of the year as the upcoming quarterly results confirm the earnings and cash flow trajectory. The setup is what can emerge as an excellent dividend stock going forward, with a fresh start by putting the 2020 suspension in the rear-view mirror.

The question becomes if Ford chooses to resume the dividend at the old quarterly rate or potentially start with a more moderate level as a nod to long-term sustainability. For context, the old dividend of $0.15 per share represented an annualized payout of $2.4 billion. This level would be approximately 60% of the company’s 2021 free cash flow guidance of $4 billion at the midpoint. As long as Ford can continue generating positive free cash flow and higher earnings, the dividend will be sustainable.

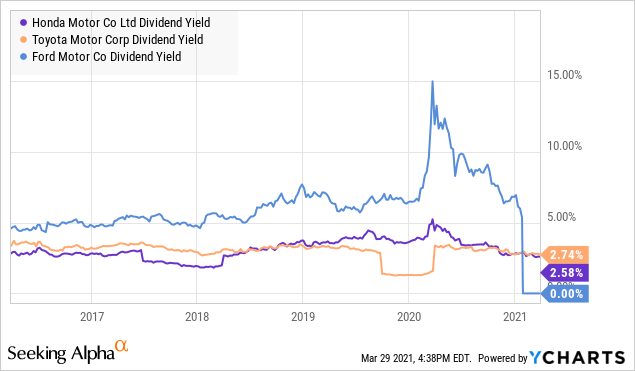

We estimate the new dividend amount would be set lower targeting a dividend yield range between 2% and 3%, to be comparable with other car manufacturers that currently distribute dividends. Toyota Motor Co and Honda Motor Co for example, have continued to pay dividends which currently yield about 2.7% and 2.6% each, respectively. For Ford to stay in this range, a quarterly dividend amount of $0.075 per share would represent a potential yield on the stock of 2.5%.

The annualized payout of our dividend estimate around $1.2 billion would be half the old rate and represent a 30% payout ratio on the 2021 guidance free cash flow estimate. We believe a new dividend in this range would strike a balance in rewarding shareholders and income investors while acknowledging that the old amount was potentially too aggressive. The upside is that a lower dividend rate now can offer room for potential dividend rate hikes going forward as earnings accelerate.

For us, Ford checks off all the boxes as to what we believe can make a great dividend stock. This is a company recognized for quality products and innovation with a strong brand awareness globally that we believe is entering a new stage of higher long-term growth. The combination of recurring profitability and growth potential can support a dividend-growth profile over the next decade. We are buying into Ford’s EV strategy and see the recent success of the Mustang Mach-E as a sign that the company has found the formula that will connect with consumers while capturing market share.

A look at Ford’s Valuation

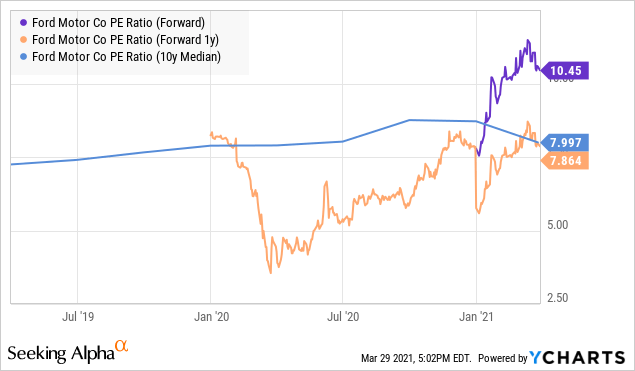

Over the past decade, Ford has traded at an average P/E multiple of about 8x. Based on the current market consensus earnings estimates, shares of F are trading at a forward P/E of 10.5X and 7.9x based on the 2021 and 2022 EPS estimate. Again, this is in an environment where revenues are expected to climb 25% this year and EPS accelerate growing forward benefiting from the strategy changes and push towards EVs. The bullish case for the stock is that shares of F deserve some valuation multiples-expansion. By this measure, we believe shares are not only attractive but even cheap at the current level. We sense that the market still does not appreciate the new profitability potential as margins climb higher.

Risks to Watch

Beyond the risk that the macro outlook deteriorates, it’s worth noting there have been some concerns related to an ongoing shortage in the semiconductor industry and its impact on the automobile industry. Part of the challenge goes back to the pandemic which created supply chain bottlenecks across the chips industry in combination with what has been recording demand. Keep in mind that automobiles from Ford and other manufacturers are utilizing more sophisticated levels of technology that require advanced on-board computers as a major source of demand for specialized chips and related hardware.

The risk here is that a prolonged shortage could begin to impact auto production volumes worldwide thereby limiting sales and earnings. Ford Management discussed this possibility back during the Q4 earnings conference call citing a scenario where 10-20% of its first-half production is lost which would result in an estimated $1.0 to $2.5 billion hit on full-year EBITDA against the current $8.0 to $9.0 billion guidance. While clearly a material level, the assumption is that the situation is temporary, and the company could recover volumes over time while the financial impact is manageable. From the conference call:

The global semiconductor shortage is creating uncertainty across multiple industries and will influence our operating results this year. The situation is changing constantly, so it’s premature to size what the shortage will mean for our full year results. However, right now, our current estimates from suppliers support a scenario, where we could lose 10% to 20% of our planned first quarter production. If that scenario is extended through the first half, this could adversely impact our full year adjusted EBIT by between $1 billion and $2.5 billion, net of reasonable cost recoveries and some production makeup in the second half of the year…

That said, we ended 2020 having achieved positive lasting change in the underlying trajectory of our earnings power, including the ability of our automotive business to generate consistent levels of strong free cash flow over time.

Should you buy Ford before it restores its dividend?

There’s a lot to like about Ford in 2021 and we expect the company to continue generating positive operating and financial momentum. We rate shares of F as a buy with a price target of $15.50 representing a 10x 1-year forward P/E on the current 2022 EPS consensus estimate. Investors buying shares now can capture some appreciation potential in shares while the possibility of a dividend being reinstated later this year would be an additional upside catalyst for the stock.

In the near term, while headlines related to the ongoing semiconductor shortage may generate some volatility and pressure the stock, it does undermine the long-term outlook and underlying turnaround story. Even at the estimated potential impact on operating income for 2021, Ford should still be able to announce a dividend by the year-end.