Conscious Venture Partners has $18 million in assets under management, managing partner Jeff Cherry told investors in an email at the end of January, ahead of presenting a full scorecard for 2022.

In the email, Cherry said the firm was in the due diligence phase considering additional investments of “$5M-$8M.” To date, “we’ve invested about $6.3M in 42 companies,” slightly more than the projected 20 investments per year , he added Some of Its recent investments include CarpeDM, PONS, EcoMap Technologies, Givhero and Sage. Two of its portfolio companies have shut down

The higher rate of portfolio investments was “mainly due to additional deal flow from investment partners (TEDCO, Evergreen Advisors, MCVC Partners) and other ecosystem players (UpSurge, Techstars, etc.),” said Cherry, a former NCAA DIII football player. The primary source of deal flow, however, is the Conscious Venture Lab, an affiliated business accelerator located in Baltimore which will now be run by a newly formed not-for-profit.

Conscious Venture Lab recently concluded a 16-week program for its ninth cohort, which consisted of “25 impressive companies” from six countries and 12 U.S states. Thirteen of the companies were from Baltimore, and 19 were from Maryland. Companies in the lab’s ninth cohort operate in diverse areas, including use of data and automation in cancer care, wearables to measure and alleviate stress in athletes, and an ag tech company developing products for generating renewable energy and crops.

In 2021, Conscious Venture Partners launched its second fund and had closed $15.8 million in 2022. Cherry hopes to close the fund this spring at $50M and is currently in discussions with investors for roughly $60M toward that goal.

Commercial Real Estate

MacKenzie Companies

Advertising / Media / Communications / Public Relations

Nevins & Associates

Financial Services / Investment Firms

Chesapeake Corporate Advisors

Commercial Real Estate

Monday Properties

Venture Capital

Blue Delta Capital Partners

Internet / Technology

Foxtrot Media

“The Conscious Venture Fund II team and our investment committee is now about to begin interviews and final due diligence to determine which of these companies we will add to the CVFUND II portfolio,” Cherry said.

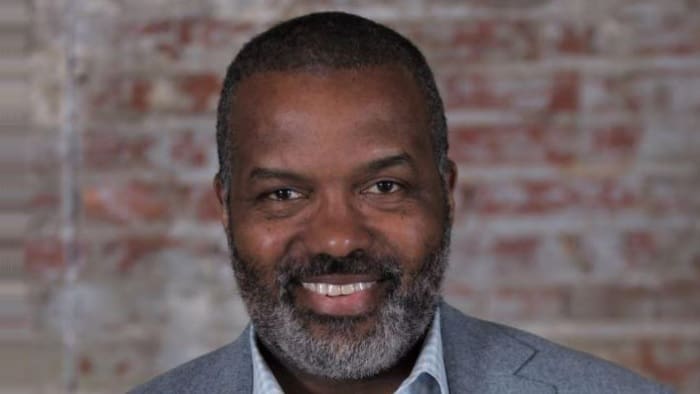

In a 25-year-long executive career, Cherry has worn a number of hats, and continues to do so. A New York native, he has played football for Catholic University as a defensive back, and served on the board of the James Beard Foundation, the New York-based culinary arts organization. Among other things, he has served as CEO, hedge fund manager and startup evangelist, guiding Johns Hopkins Technology Ventures (JHTV), Maryland Momentum Fund and others. He has taken Conscious Venture Lab international with a foray into Mexico, and also set up a startup challenge in Italy. Cherry’s business philosophy is inspired by the concept of “Conscious Capitalism,” and by thought leaders such as David Wolfe and Raj Sisodia, authors of the book “Firms of Endearment, How World Class Companies Profit from Passion and Purpose.”

With bachelors and masters degrees in Architecture from The Catholic University of America in Washington, D.C. Cherry set out to be an architect but soon switched to IT and management consulting. He has completed extended executive study courses at some of the best schools across the country, including the Stanford Graduate School of Business.