Michael Vi

Summary

- Palantir Technologies posted GAAP-positive earnings in Q1, but questions linger about the sustainability of those earnings.

- Palantir launched its new AI product, but leadership was very light on details about the go-to-market strategy.

- Overall, we find it difficult to believe that PLTR will be able to sustain long-term profitability.

Much Ado

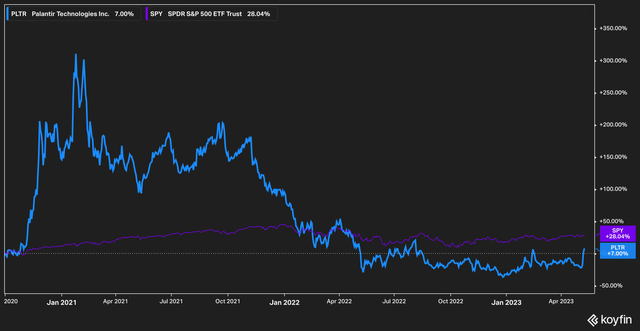

Palantir (NYSE:PLTR), the data-analytics firm that distributes multiple software platforms designed to corral large amounts of data for private firms and governments, has had quite the ride since its IPO.

Koyfin

After surging more than 300% in 2021 from its IPO price, the stock has fallen back to earth. The investing public has had a few concerns about the company, including large amounts of stock-based compensation that have increased the overall share count by 28% since the company went public, and a unique three-class share structure that affords the company’s founders complete control, more or less.

READ FULL ARTICLE HERE!