Summary

- McCormick’s Q3 results show a significant increase in cash flow from operations and improvements in inventory management.

- The company’s governance programs are starting to show positive effects on inventory reduction and cost savings.

- McCormick reaffirmed its revenue and profit outlook for FY 2023, but controllable expenses and volume declines are concerning.

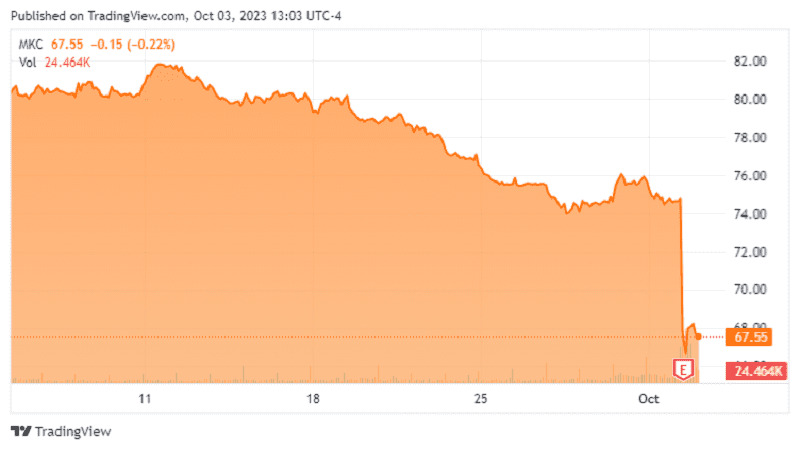

McCormick & Company (NYSE:MKC), the company associated with food flavor globally, just reported its Q3 results this morning (October 3rd, 2023) as Seeking Alpha has covered here. The stock is down close to 3% pre-market as of this writing, which suggests that the market did not like something about the report or the guidance. Let’s take a closer look at McCormick’s spicy version of The Good, The Bad, and The Ugly.

The Good

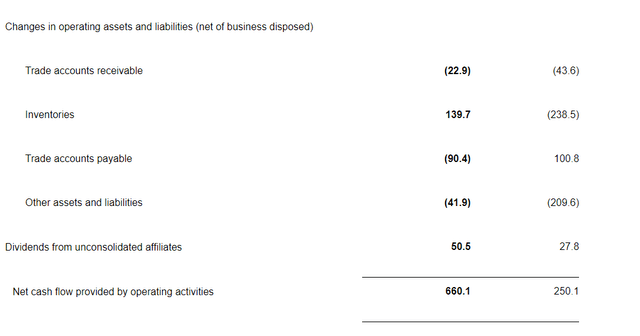

- Inventory Looking Better: Cash flow from operations went up a mind-boggling 164% to reach $660 million in Q3. This was primarily driven by the fact that inventories and other assets/liabilities went from -$447 million in Q3 2022 to $97.8 million in Q3 2023. In its Q3 2022 report, the company had highlighted that managing inventory and eliminating inefficiencies was a primary goal, and it appears like they’ve more than followed through on that in Q3 2023.

MKC Cash Flow (ir.mccormick.com)

- Governance Programs: McCormick continues to publicly bring up its two programs aimed at Comprehensive Continuous Improvement (‘CCI’) and Global Operating Effectiveness (‘GOE’) in every single quarterly report. The effects of these programs are beginning to show up in inventory reduction and Cost of Goods Sold [COGS]. The GOE program is expected to contribute $125 million in annual savings.

- Guidance Reaffirmed: McCormick reaffirmed its revenue and profit outlook for FY 2023 (with one quarter remaining) and increased its adjusted EPS range to $2.62 to $2.67 from the previous range of $2.60 to $2.65. But there is a catch here as covered in the section below.

- Pricing Power: McCormick’s Q3 report was flavored (pun intended) with the words “pricing actions” 14 times. Across all three regions the company reports by (Americas, Europe, Middle East and Africa [EMEA], and Asia-Pacific region [APAC]), pricing power helped the company offset volume declines, which is covered below. Overall, the 6% sales growth was from the 8% price increase, which was offset a little by the 2% volume decline.