- Nike is widely expected to benefit as youth and professional sports work towards “full speed” following the pandemic.

- The stock’s lack of price momentum in recent months combined with bullish estimates may tempt investors into buying shares.

- However, the stock is extremely overvalued, with near-term catalysts more than priced in. Nike is a poor investment opportunity at this time.

Sports apparel company Nike, Inc. (NKE) is one of the world’s most iconic brands. Its famous “swoosh” logo is found in all sports and markets throughout the planet. Nike has also been a fantastic investment over the years, far outpacing the S&P 500 going back decades. As the pandemic fades and society returns to sports participation (both professional and youth), Nike is poised for an uptick in growth.

Despite this recovery potential, investors need to be careful with Nike stock. The current valuation is extremely aggressive, and the upcoming growth is more than priced into the current share price. Nike is a quality business that I would hesitate to sell, but it’s certainly tough to make the case to buy shares at these levels.

Recapping Nike’s Fantastic Fundamentals

Nike is a very well known brand, recognized by its trademark “swoosh” by consumers in all markets across the planet. While a recognizable brand doesn’t necessarily make it a strong business model, Nike happens to be a very strong company.

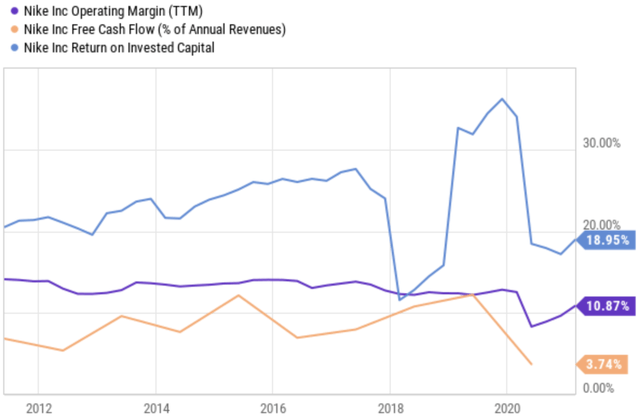

Nike has generated great returns for investors by combining steady revenue growth with high margins and strong returns on capital. Up until the pandemic, Nike has converted roughly 10% of each revenue dollar into cash flow. It has consistently sustained a 20%+ return on capital, and indication of a “moat” in its business. When you are growing revenues (7% CAGR over past decade) and generating strong operating metrics, investors will benefit.

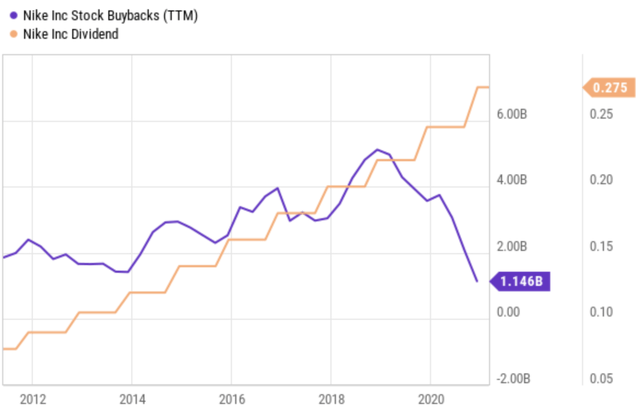

Nike has consistently outperformed the S&P 500 over the years. Nike’s strong profitability and growing revenues have created cash flows that have fueled shareholder returns (stock buybacks and dividends), as well as strong earnings growth.

Nike has raised its dividend for each of the past 18 years, and has repurchased billions of its own stock. The company’s EPS have grown at a CAGR of 12.6% over the past decade (if we exclude the pandemic year). I have been bullish on Nike’s business since 2018 when it had reestablished itself as a “growth company”. Since then, the stock has returned more than 87%.

Growth Is Set To Accelerate As Sports Return

The primary draw to Nike for investors these days, is the idea that the company will benefit as a “reopening play”. That Nike will see accelerated growth as both professional and youth sports slowly return to full speed. This optimism is shared by the analyst community.

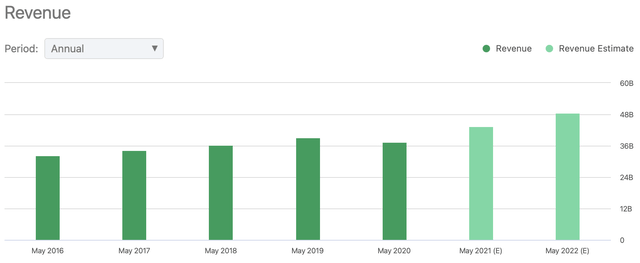

From FY16-FY19, revenues grew a total of $6.74 billion or 20.8% over a three year period. This works out to a CAGR of 6.51% over that time. The pandemic impacted Nike’s business, knocking revenues down to $37.4 billion in 2020.

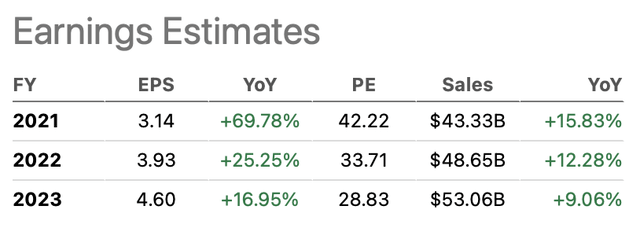

Nike is poised to see a recovery in sales, growing to new heights over the next few years. Analysts are projecting revenues as follows:

- 2021: $43.33 billion (YoY growth of 15.8%)

- 2022: $48.65 billion (YoY growth of 12.3%)

- 2023: $53.06 billion (YoY growth of 9.0%)

Nike was already consistently growing revenues at a high single-digit rate, so the pent-up demand for sports following Covid (and an Olympics) is adding material expected growth to forecasts. A few years out we can see that estimates are tailing off, heading back down towards a more normalized high single-digit rate.

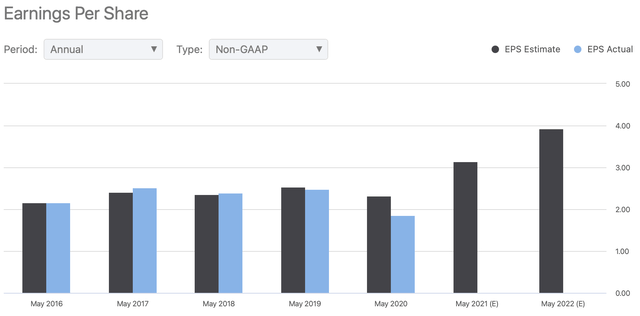

The rebound in margins following Covid combined with accelerated revenue growth should ramp up EPS growth with it. Analysts are projecting EPS this year of $3.14 (YoY growth of 70%) and $3.93 next year (YoY growth of 25%).

The Valuation Is Far Too Hot

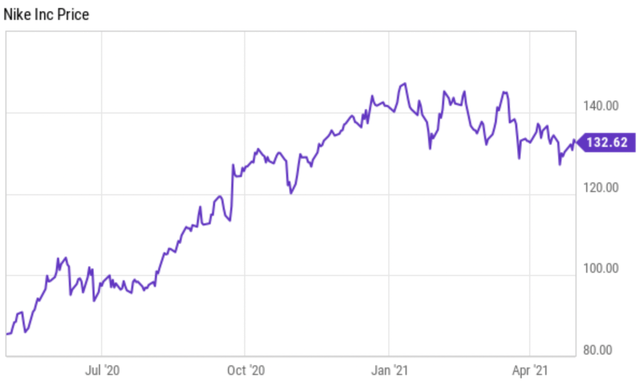

At just over $132 per share, Nike is off of 52 week highs and near its lowest levels since before the new year. The stock’s lack of recent momentum and expected uptick in revenue/earnings growth would give the impression that the stock is attractively valued.

However, it turns out that this isn’t the case. Let’s bring back the expected performance of Nike over the next couple of years:

Over the past decade, Nike has traded at an average earnings multiple of 25.6X. Over that time frame, Nike has averaged roughly 7% revenue growth and 12% EPS growth.

Against EPS estimates for the next three years, Nike is currently trading at earnings multiples of:

- 2021: 42.2X (65% premium to historical norms)

- 2022: 33.7X (32% premium to historical norms)

- 2023: 28.8X (12% premium to historical norms)

Despite an expected surge in near term growth, Nike is aggressively overvalued. It is clear that near term upside has been more than factored into the existing share price. I don’t see justification of a rerating beyond Nike’s historical valuation because I expect long term performance beyond 2023 to continue reverting back to long term growth rates established prior to the pandemic.

Wrapping Up

Nike is a fantastic business that has been on a multi-month pullback. However, the stock remains overvalued, despite the company being an expected beneficiary to the post-covid “reopening”. Investors need to remember that valuation always matters and that a strong company doesn’t always equate to a strong investment. Nike is a “hold” in my view, as its strong fundamentals would prevent me from selling outright.