Summary

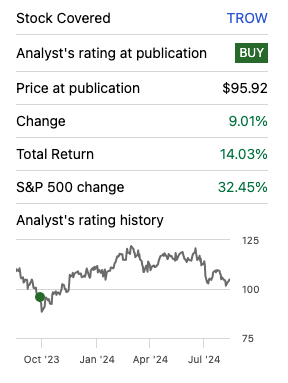

- T. Rowe Price Group Inc. has delivered a 14% return since my Buy recommendation, but has trailed the S&P 500’s 32% return.

- AUM has risen due to strong equity market performance and improving long-term flows.

- TROW’s valuation is now more attractive relative to the broader market and peers than was previously the case.

- I view TROW as highly attractive at current levels and am upgrading the stock to a Strong Buy.

Shares of T. Rowe Price Group Inc (NASDAQ:TROW) have delivered a total return of 14% since my initial Buy recommendation, T. Rowe Price: Why I Would buy The Dip was published on October 24, 2023. Comparably, the S&P 500 has delivered a total return of 32% over the same time period.

While the stock has moved higher from my initial recommendation, the valuation picture has improved on both a standalone basis and relative to peers. Moreover, I believe the company is in a strong position now as assets under management (“AUM”) have moved significantly higher and net flows have improved significantly. For these reasons, I am upgrading the stock to a Strong Buy from a Buy.

Seeking Alpha