G0d4ather

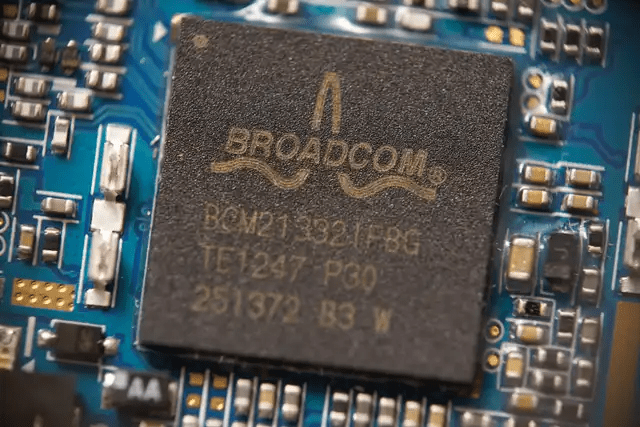

- Broadcom targets a $150 billion AI semiconductor market with 30-40% annual growth, driving significant revenue potential.

- Fiscal 2024 AI revenues projected at $12 billion, growing 33% YoY, with $16 billion expected in 2025.

- Key AI customers include Google, Meta, and ByteDance, with potential collaboration from OpenAI further strengthening the market position.

- VMware acquisition boosted infrastructure software revenue by 200% year-over-year, contributing $3.8 billion in Q3 alone.

- Broadcom faces high debt obligations of $72.3 billion, with floating-rate debt posing risks in the midterm.

Investment Thesis

Broadcom Inc. (NASDAQ:AVGO) is poised for capture with rising AI semiconductor demand, making for a compelling investment opportunity. Assuming the market for AI semiconductors reaches up to $150 billion in the next five years, Broadcom has designed AI-specific chips.

Yiannis Zourmpanos, founder of Yiazou IQ, an AI-driven stock research platform providing all-in-one stock reports. Experience: Previously worked at Deloitte and KPMG in external/internal auditing and consulting. Education: Chartered Certified Accountant, Fellow Member of ACCA Global, with BSc and MSc degrees from U.K. business schools. Investment Style: We focus on GARP/Value stocks—high-quality, reasonably priced businesses with strong moats and significant growth potential. We prioritize fundamentals and seek stocks trading at a discount to intrinsic value, with a clear margin of safety. Our long-term approach (5-7 years) aims for wealth accumulation through compounding while emphasizing downside protection and sometimes taking contrarian views during market uncertainties.

READ FULL ARTICLE HERE!