- Most analysts covering NVDA are currently focused on GPU demand from data centers as signals for future stock price performance.

- The truth is, Nvidia is also strongly positioned to capitalize on the next leg of this AI revolution, to which savvy long-term investors grant greater importance over the short-term noise.

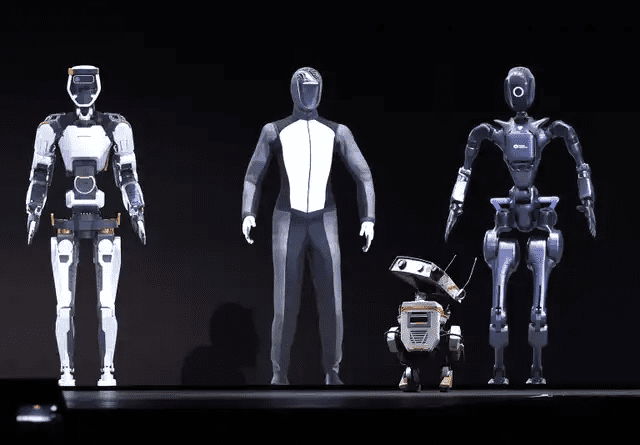

- We discuss Nvidia’s massive hardware and software revenue potential as AI powers another extraordinarily exciting market.

Most analysts covering NVIDIA (NASDAQ:NVDA) (NEOE:NVDA:CA) are currently focused on GPU demand from data centers as signals for future stock price performance.

In fact, in the previous article, NVDA stock was downgraded to a ‘hold’ as signs of Nvidia losing pricing power and profit margin compression raise the risk of a massive pullback in the share price. We also covered how the rise of open-source software threatens Nvidia’s competitive moat, as per historical analogies from previous tech cycles.

Though Nvidia CEO Jensen Huang did come out recently to proclaim that “demand for Blackwell is insane”, sending the stock rallying to reach new all-time highs, and admittedly subduing the chances of a major pullback any time soon.

READ FULL ARTICLE HERE!