Boost Insurance, a NYC-based B2B digital insurance platform, completed a $20m Series B financing.

The round, which brought total funding raised to date to $37m, was led by RRE Ventures with participation from new investors Fin VC, Gaingels, Hack VC and a global publicly traded reinsurance company along with existing investors Greycroft, Coatue, and Conversion Capital.

The company intends to use the funds to accelerate growth of its platform new product development and partner marketing, double its team over the next 12-18 months to support growth across its insurtech and embedded partner channels while continuing to expand its API platform features, and roll out a number of additional insurance products in 2021 in collaboration with its partners in the insurtech and broader technology industries.

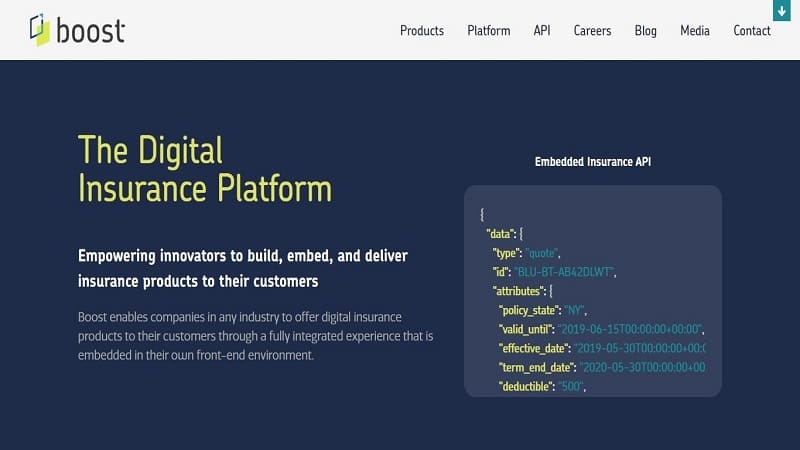

Founded in 2017 by Alex Maffeo, CEO, Boost provides an integrated insurance-as-a-service platform which allows innovative companies from any industry to build, embed, and manage insurance programs for their customers. Its API integration packages the necessary operational, compliance, and capital components to allow companies to deliver configurable insurance products directly to consumers through an embedded experience within their own front-end environments.

Boost powers dozens of digital distribution clients across all industries and stages, including notable insurtechs Hippo, Aon’s CoverWallet, Cowbell Cyber, and Wagmo, and leaders in diverse fintech, proptech, and other B2B and consumer segments.

The company is licensed and authorized to produce any type of insurance across all 50 states.