Summary

- JWN reports earnings May 25. Revenue is recovering, yet it may take a while before it rebounds from pre-pandemic lows.

- EBITDA margin is in the single-digit percentage range. It should improve with added scale.

- Negative working capital could have an impact on the company’s credit rating. JWN may have to raise new capital at some point.

- EBITDA may have to return to pre-pandemic levels to justify JWN’s market capitalization. For now, I rate the stock a hold.

- This idea was discussed in more depth with members of my private investing community, Shocking The Street. Learn More »

Nordstrom (JWN) reports quarterly earnings May 25th. Analysts expect revenue of $2.86 billion and EPS of -$0.63. The revenue estimate implies a sizable increase Y/Y. Investors should focus on the following key items.

Revenue Is Recovering

Traditional retailers like Nordstrom have had a tough go of it over the past few years. Some had to resort to discounting in order to drive traffic to their stores. The pandemic amplified that pain, causing Nordstrom to close several stores amid shelter-in-place policies. The revenue estimate implies growth of over 40% year-over-year. However, it would imply a decline of over 10% compared to the quarter ended May 2019, suggesting revenue may not return to pre-pandemic levels.

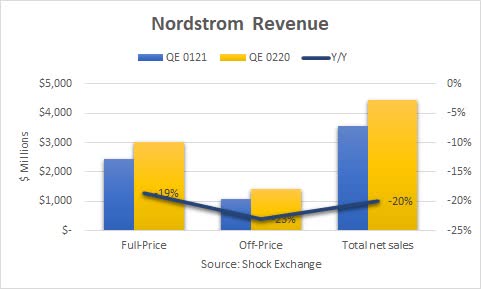

Chatter suggests 25 states have 40% or more of their population vaccinated. As this figure rises, (1) the reopening of the U.S. economy could speed up and (2) more shopping could take place in physical locations; this would likely benefit traditional retailers like Nordstrom. For the quarter ended January 2021 Nordstrom generated revenue of $3.6 billion, down 20% Y/Y.

Nordstrom’s core apparel sales may not experience sustained revenue growth until Americans return to the office or kids return to schools. For the Nordstrom brand, revenue was $2.5 billion, down 19% Y/Y. Revenue for Nordstrom Rack brand was off 23%. Digital sales increased 24% Y/Y and represented 54% of total sales. About 10% of online orders were picked up in stores. Sales of Nordstrom’s off-price brand could become stickier if consumers become more cost conscious in future. Its full-price and off-price brands could present the opportunity to attract high-end customers and cost-conscious customers in the same location.

Nordstrom’s core apparel sales may not experience sustained revenue growth until Americans return to the office or kids return to schools. For the Nordstrom brand, revenue was $2.5 billion, down 19% Y/Y. Revenue for Nordstrom Rack brand was off 23%. Digital sales increased 24% Y/Y and represented 54% of total sales. About 10% of online orders were picked up in stores. Sales of Nordstrom’s off-price brand could become stickier if consumers become more cost conscious in future. Its full-price and off-price brands could present the opportunity to attract high-end customers and cost-conscious customers in the same location.

Margins Fell

The decline in scale hurt margins. Gross margin was 33%, down 160 basis points vs. that of the year-earlier period. Margins were hampered by mark downs and falling scale. Gross profit on a dollar basis was $1.2 billion, down 24% Y/Y. SG&A costs were $1.3 billion, down 8% Y/Y. The company will likely incur a certain level of selling costs even amid revenue declines.

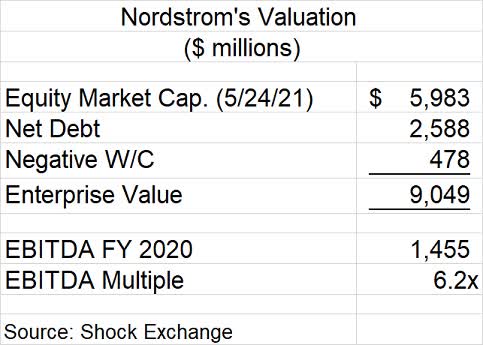

The fallout was that EBITDA of $187 million was down over 60% Y/Y. EBITDA margin was 5%, down from 11% in the year earlier period. If the company can add scale, Nordstrom’s EBITDA margin should begin to the return to the double-digit percentage range the company previously enjoyed. The ability to grow EBITDA is important, as it will likely be used to justify the company’s $6.0 billion equity market capitalization.

Negative Working Capital Could Impact Credit Ratings

Nordstrom ended the quarter with $681 million in cash and equivalents, down from $853 million in the year earlier period. Working capital was -$478 million, down from -$290 million in the year earlier period. Working capital included $1.9 billion in inventory, which was practically flat vs. that of the year earlier period. I would have expected the inventory balance to have declined, given the decline in sales. This implies the company could be having a difficult time paring inventory.

If Nordstrom has to sell product at a discount then it could potentially hurt gross margin in the future. Free cash flow could also be negatively impacted. Cash burn for the most recent fiscal year $733 million, down from positive FCF of $301 million in the year earlier period. Growing net income could help cash flow. However, cash flow could be most sensitive paring inventory. Nordstrom should be monetizing working capital, while the business is in decline.

In March Moody’s assigned a Baa3 to Nordstrom’s proposed senior unsecured notes offering. This is considered lower medium grade status. According to Moody’s, the rating could be downgraded if “EBIT to interest expense is sustained below 3.5x times and debt to EBITDA is sustained above 3.75x.” The company’s EBITDA for the year-ended January 2021 was negative. Assuming EBITDA returned to 2020’s level of $1.5 billion, its debt plus negative working capital of $3.7 billion would be 2.6x EBITDA. This would still not trigger a ratings downgrade. However, if the company’s EBITDA does not return to pre-pandemic levels then it could become a point of contention for the rating agencies.

I believe it’s also time to sharpen the pencils on the company’s valuation. Including its negative working capital as debt, JWN would have an enterprise value of about $9.0 billion. This would equate to 6.2x FY20 EBITDA of $1.5 billion.

The valuation also assumes the company could increase EBITDA to pre-pandemic levels. I would expect JWN to trade at 8x-10x EBITDA, which in a normal environment would make its current stock undervalued. However, if or when Nordstrom’s EBITDA can return to 2020’s level remains to be seen. Management’s outlook is key. If financial results can return to pre-pandemic levels then it could change my sentiment pursuant to the stock.

The valuation also assumes the company could increase EBITDA to pre-pandemic levels. I would expect JWN to trade at 8x-10x EBITDA, which in a normal environment would make its current stock undervalued. However, if or when Nordstrom’s EBITDA can return to 2020’s level remains to be seen. Management’s outlook is key. If financial results can return to pre-pandemic levels then it could change my sentiment pursuant to the stock.

Conclusion

JWN has more than doubled over the past year, versus a 38% return for the S&P 500 (SPY). I rate JWN a hold until its current EBITDA can justify its valuation.

I also run the Shocking The Street investment service as part of the Seeking Alpha Marketplace. You will get access to exclusive ideas from Shocking The Street, and stay abreast of opportunities months before the market becomes aware of them. I am currently offering a two-week free trial period for subscribers to enjoy. Check out the service and find out first-hand why other subscribers appear to be two steps ahead of the market.

Pricing for Shocking The Street is $35 per month. Those who sign up for the yearly plan will enjoy a price of $280 per year – a 33% discount.