Summary

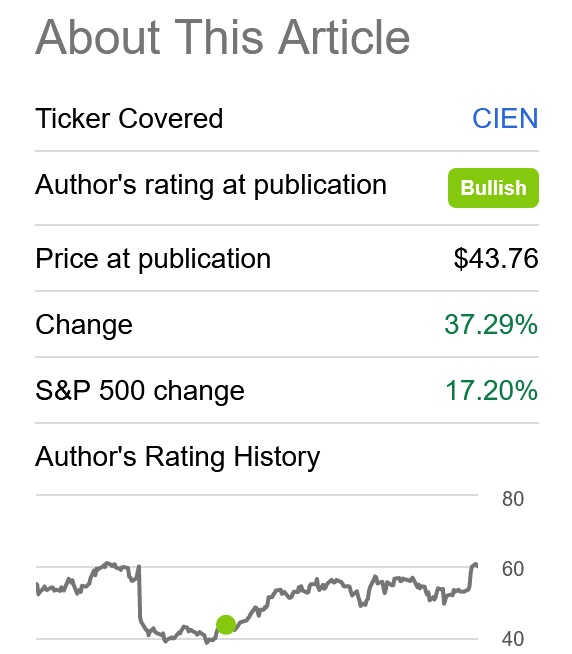

- Ciena returned more than double that of the S&P 500 since Nov. 2020.

- Strong quarterly results lifted the stock recently.

- Buy more shares if it dips.

- This idea was discussed in more depth with members of my private investing community, DIY Value Investing. Learn More »

When Ciena (CIEN) fell from $60 last summer to around $40, investors who swooped in to buy the dip earned double that of the S&P 500’s return. CIEN stock returned around 37%, compared to the index’s 17.2% after this publication.

Why did communications equipment supplier Ciena sustain an uptrend and then break out on June 3?

Data courtesy of SA Premium

Above: CIEN stock return since its “BUY” rating on Nov. 15, 2020.

Ciena is a telecommunications networking equipment and software services firm. In the networking segment, the stock is cyclical in nature. Its booming business may follow with a slowdown. This pattern is similar to Cambium Networks (CMBM), as covered here.

READ FULL ARTICLE HERE