- Microsoft is scheduled to announce Q1 results on Oct. 27.

- Readers and investors may want to monitor its segment financials, the performance of its recurring revenue-generating services and Azure’s performance.

- Given its track record, the stock is likely to outperform the Street’s revenue estimates once again.

All eyes will be on Microsoft (MSFT) when the software giant reports its Q1 results next week on Oct. 27. The stock has rallied by more than 50% in the last 12 months and investors would be curious to see if the company’s upcoming earnings report has enough positives to bolster its rally going forward. So, today, I want to discuss a few important items that should be on everyone’s radar when Microsoft announces its next earnings report. These items – bifurcated financial performance, Azure revenue and the growth of recurring-service revenues – are likely going to determine where the stock heads next. Let’s take a closer look at it all.

Segment Financials

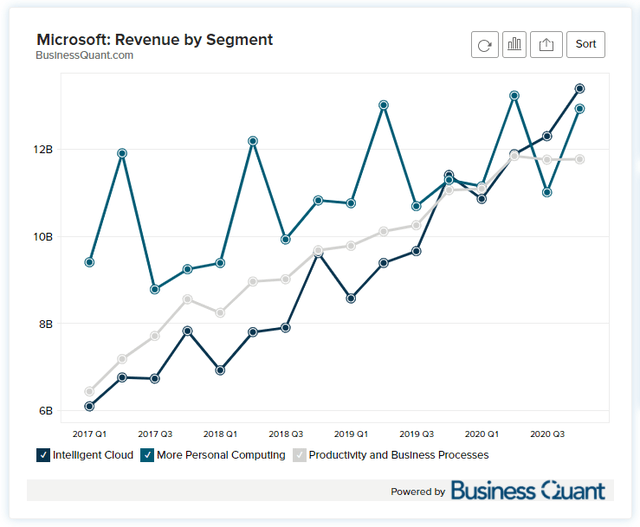

For the uninitiated, Microsoft has three reporting segments, namely Intelligent Cloud, Product and Business Processes and More Personal Computing that have a nearly identical revenue contribution to the overall top line. All three of its mentioned segments have been growing consistently for several quarters now.

(Source: Business Quant)

Companies eventually hit a saturation point after growing continuously for an extended period of time due to a myriad of reasons – such as exhaustion of growth initiatives, managements developing a laid-back approach, sizable base effect, etc. But Microsoft’s consistent segment-level growth trajectory suggests that it’s far from hitting this saturation point which is a truly commendable feat considering its massive size. But as far as Q1 is concerned, readers and investors should monitor Microsoft’s segment revenues to get a sense of whether its growth momentum is continuing or if parts of its business are succumbing to macroeconomic pressures of late.