- Tesla is set to lose significant market share in the European EV market in 2020 and 2021.

- Legacy automakers are pushing BEV and PHEV sales in the EU in order to avoid paying massive fines for breaching new CO2 limits.

- While Tesla is likely to regain some of the market share losses starting in 2022, the near-term issues will challenge the company’s story-driven stock price.

- I think it’s likely that the company will try to pivot the investment case away from the auto sector.

Introduction

Tesla (TSLA) has been steadily losing market share in the European Union (EU) electric vehicle (EV) market during 2020 and there have been several articles on SA covering this development (examples here, here and here).

However, the reasons for this are rarely discussed and no one seems to be talking about what we can expect in 2021. Mea culpa, as I also focused too much on the present in my previous article on Tesla. So here’s my take on what next year and the years beyond might look like.

Overall, the emerging competitive pressure in Europe is likely to dent Tesla’s momentum in the near future, which is likely to have a negative effect on share prices. The company will need to pivot, but I think this will be hard to achieve.

Why automakers in the EU are entering the EV market in 2020

As I mentioned in my previous article, Europe has become the leading EV market in the world in 2020 after surpassing China.

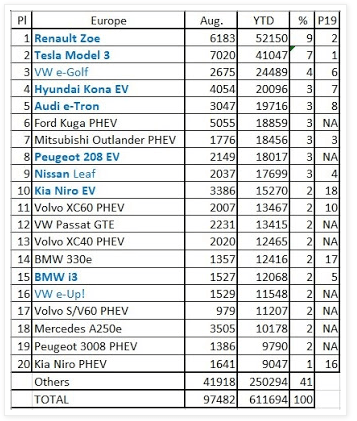

(Source: EV Sales)

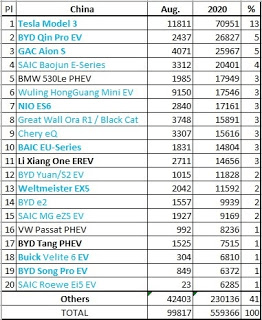

(Source: EV Sales)

One might come to the conclusion that us Europeans have finally embraced EVs but that is far from the truth. I live in Bulgaria and there are just around 1,700 battery electric vehicles (BEVs) in the whole country, around a third of which belong to a car rental company named Spark. The reason is that EV ownership in the EU is largely driven by government incentives and the compelling ones exist mainly in rich countries like Norway, Germany and France.