Summary

- Hilton has seen terrible businesses operation since the pandemic, and has persisted into Q1 of 2021.

- While the outlook for the U.S. is good, the rest of the world is still lagging within the industry.

- Even after a rebound to pre-pandemic business levels, Hilton trades at a loft valuation.

User10095428_393/iStock Editorial via Getty Images

Introduction

The COVID-19 pandemic has hit the travel and leisure industry very hard. With so few people going anywhere outside their homes, companies like Hilton (HLT) have really struggled. While airlines and restaurants start to regain ground, the hotel business has still lagged. Hilton has a nice past performance, but 2020 and the first quarter of 2021 have shown continued poor results. To add to this, the company has a weak balance sheet and a high valuation. Because of these factors, I wouldn’t start a long-term position in Hilton.

Historic Performance

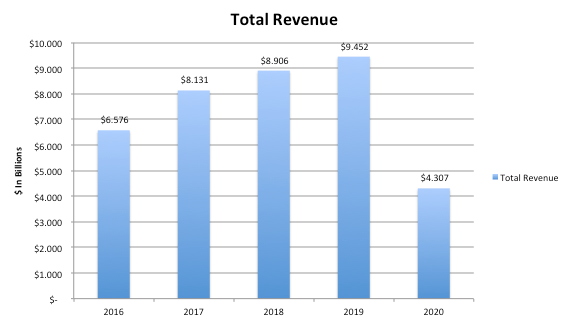

Source: SEC 10-K’s

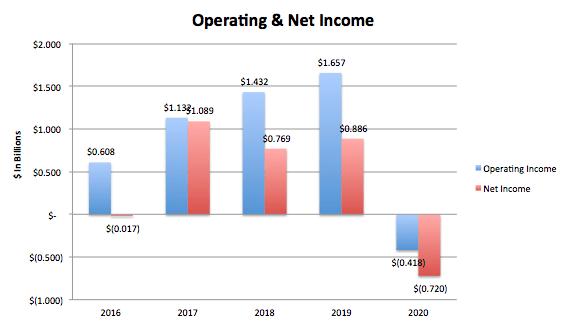

Source: SEC 10-K’s

As can be seen before 2020, Hilton had a steady top-line growth pattern in place. From 2016 to 2019, revenue grew by 9.49% per year. But in 2020, total revenues declined by 54.43% due to the pandemic. The same can be said with operating income, with the company posting a CAGR of 28.49% from 2016 to 2019, and a drop off of 125% in 2020. Net income, on the other hand, has been rather volatile. This has been due to a change in accounting processes and an income tax benefit.